|

|

I would like to ask if Nintendo is planning any new undertakings other than the manufacture and sale of entertainment products including video games, playing cards and karuta. Also, please let us know if Nintendo is going to introduce a special benefit plan for shareholders in the future. |

|---|---|

|

|

Iwata: Physically, even a small amount of power can have a great effect when concentrated on a certain area. I think Nintendo has carved out a new future in this manner. In other words, we should not spread ourselves thin by diversifying our business because, by doing so, we might lose a strong presence which we currently have in the area of entertainment. We therefore have no intention to advance into other markets. Nintendo is an entertainment company. I have received requests for a shareholders’ special benefit plan in previous shareholders’ meetings, but please let me answer it again. We have a lot of institutional shareholders as well as individual shareholders. Since institutional shareholders see a special benefit plan for shareholders as something they cannot take advantage of, paying for such a plan will not necessarily meet with the approval of all the shareholders. As I answered in the past shareholders meetings, we have not introduced any shareholder benefit plans for such reasons. Thank you for your understanding. |

|

|

Nintendo Direct enables Nintendo to deliver what it wants to communicate when it wants to communicate it, but I have seen reports by certain media that contained claims about Nintendo that were either misleading or contrary to fact, and Nintendo even had to officially deny them several times in the past. I also believe that some major sites on the Internet sometimes produce biased and distorted articles about the company. For shareholders, this affects Nintendo’s share price, and for non-gamers, this paints a negative picture of games in general. What does Nintendo think about this and how are you going to deal with it? |

|---|---|

|

|

Iwata: Let me first say that I would like to refrain from commenting on individual cases. On the other hand, it is true that there are some Internet sites and certain media who have written stories about Nintendo as if they were official when, in reality, they did not come from any official sources such as interviews or announcements, nor were they confirmed by the company. My words are sometimes taken out of context, rephrased in a way that sounds offensive, and then reported as if those were my exact words. We look at the influence and the content of any article and media, and when we feel that it could potentially spread misleading information (on a wide scale), then, as other companies do, we sometimes decide to communicate on our official website and Twitter account that what the article in question claims is nothing that the company has officially announced. In this sense, we are proactive with regard to information that, if left unattended, could affect us in an extremely negative way. On the other hand, what people say on the Internet is simply beyond our control. There have certainly been instances where we felt very sad or frustrated, but reacting to every single piece of information could in fact contribute to spreading it further. We take action when we feel that a certain piece of information could affect us or our shareholders in a negative way. We have Nintendo Direct, our official Twitter account and our official website to communicate our messages to our consumers directly. An increasing number of people are watching videos on the Nintendo eShop, which is a virtual shop where people can purchase new games and find new information. In fact, the most popular way to watch Nintendo Direct is through the Nintendo eShop as opposed to watching it live on computers. As you can see, we now have more ways to directly reach out to consumers, and by communicating our messages in a genuine manner, I think that we can make sure that inaccurate and ill-intentioned reports will not become too serious an issue. |

|

|

I would like to ask you about the 3D feature on Nintendo 3DS. When I look at Nintendo’s own titles or those titles by other publishers that Nintendo directly supervises, I am often impressed by how well the 3D effect is fine-tuned, but I have also seen some titles from software developers that I feel have not been well adjusted in 3D. Even some recent title from a major third-party publisher showed 3D images that were clearly unnatural. How has Nintendo been supporting developers on this issue, and what are you going to do about this in the future? |

|---|---|

|

|

Iwata: We have of course conducted research to find out the level of perspective difference between left and right images that was low enough to reduce the burden on the eyes but was high enough to achieve a significant 3D effect, and we feel that we have certainly amassed knowledge and know-how since our first prototype using a 3D screen. In this sense, we share information internally in the company on what successful software has done to achieve such a high level of stereoscopic effect, and we share that with our external partners if we receive questions from them. On the other hand, it would be nonsense to claim that the quality of the 3D images of a particular game only depended on whether it was created at Nintendo or outside Nintendo. I believe that it depends on the individual title. The quality of 3D images cannot be quantified and it cannot be measured against a certain experiment to set a threshold either. It is up to the individual player to decide for himself or herself. You might get a totally different impression by simply looking at a different location on the screen, and what one person might describe as too strong could in fact produce images that another person might describe as compelling and immersive. Players have the ability to adjust what is called the 3D Depth Slider (to adjust the level of perspective difference between the left and right images on Nintendo 3DS) but in some cases, it is not adequate. From your question, I take it that you probably had the chance to watch video footage for certain games that were distributed before they officially released, but as a matter of fact, the level of parallax effect is fixed with videos, meaning that it is impossible to adjust it (using the 3D Depth Slider). In this sense, I believe that we have not been able to fully satisfy our consumers in every aspect. Of course, it is up to individual publishers to make judgments about the quality of their software in the end, but we would like to support them when necessary to find a good balance between comfortable and impressive 3D images. Thank you for your question. |

|

|

I would like to know what Nintendo is planning to do to improve shareholder satisfaction. You just told us that Nintendo is not going to have a special benefit plan for shareholders. That’s fine, but what about a share split? NISA (Nippon Individual Savings Account) will be introduced next January, in which individual shareholders will get a tax break for investments of up to one million yen per year. According to the current Nintendo share price, one unit share is selling at more than one million yen, and individuals who want to start investing in equities taking advantage of NISA next year might avoid Nintendo shares. Do you feel any sense of crisis in this? You told us that Nintendo will not introduce a shareholder benefit plan for the sake of institutional shareholders, but every company has institutional shareholders and nevertheless makes efforts to increase the number of individual shareholders. Please let us know Nintendo’s view. |

|---|---|

|

|

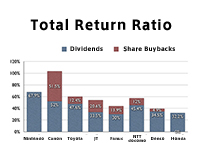

Iwata: I have often been asked about a share split in shareholders’ meetings. Before the digitalization of share certificates, I mentioned that it would require a lot of clerical costs to split a share when only real share certificates existed and that we would start considering one after the digitalization. Now we don’t have to care about such clerical costs because the digitalization has already happened. Naturally, we are internally studying the methods, and pros and cons of a share split, but we cannot talk about it in detail today. I would like you to at least understand that a share split has two aspects. When a company splits its shares, its investor base is broadened by increasing the number of individual shareholders and, as is widely alleged, the liquidity of the shares will improve. Also, as you mentioned, NISA, which is a tax exemption on small investments by individuals, will begin in January 2014 and give many people a chance to start investing in equities. We would like to think of a way to attract more people to our shares. On the other hand, as a shareholder commented in a shareholders’ meeting some years ago, some people are against a share split because it would reduce the premium nature of Nintendo shares. This is not a rare opinion as we have received this sort of opinion through various channels before. We are not disregarding the importance of our shareholders, but my explanations today have been more focused on how to satisfy our consumers to improve our business performance because doing so can increase the corporate value of Nintendo, its share price and the dividends to you all. We hope to decide if and when to split our shares, taking into account the pros and cons I stated just before. Please let me take this opportunity to tell you something to address criticisms that Nintendo may be making little of its shareholders. As we have not bought back our shares despite our share price being in a downswing phase for some time, we have received some comments that Nintendo may have no intention to support its share price or even may not care about its share price. Of course, we care about our share price and we think a share buyback is a good option if we can determine it will work effectively. Under the current circumstances, however, we think that a buyback alone cannot change a large trend without also improving corporate performance and proving that our current business structure will work well in the future. On the other hand, there is an indicator called “total return ratio,” which shows how a company returns its income to its shareholders. It generally means the ratio of the dividends and share buybacks in total to the net income for a fiscal year. For Nintendo, the ratio is 67.9 percent in total for the recent six fiscal years. The net income was 806,582 million yen and we returned 547,344 million yen to shareholders in dividends over those six years. Please let me compare this number with other Japanese companies. As there are few companies whose business and scale are similar to us, we have picked out some large-scale companies with a big market capitalization which are known as “cash rich” or have positively bought back their shares. It goes without saying that we are very sorry we could not pay many dividends due to the downturn in business for the 72nd and 73rd fiscal years, and we are making our best efforts to improve our performance so that you will be smiling here at the 74th annual shareholders’ meeting next year. However, this comparison chart shows that Nintendo belongs to the group of companies which have been most actively returning income to shareholders in the form of dividends and, even when it comes to the total return ratio which includes share buybacks, Nintendo is the highest, except for a prominent one, Canon. (Note: 56.6 percent is the six-year total return ratio of the 20 Japanese companies with the biggest market capitalizations including the companies on the slide (excluding three financial institutions) as of June 27, 2013.) Our basic dividend policy is a 50 percent consolidated payout ratio. However, we have the other policy which is to consider 33 percent of consolidated operating income as a dividend resource in consideration of the investor opinion that they would like to avoid the risk of reduced dividends in case of a strong yen causing foreign exchange losses and reducing net income, and we have adopted the higher of the two policies for years. The accumulation of dividend payments has contributed to the high total return ratio of 67.9 percent. In this sense, we would appreciate it if you could understand that we are seriously working for profit returns to our shareholders. |