|

|

I want you to elaborate on your DS business in Europe. According to the software sales charts, the software business was very healthy with previously-released titles like Brain Training in 2009. But in 2010, they have totally disappeared. Why did the European market change so rapidly and significantly? As for Japanese DS market, I find it is recovering with hits like Tomodachi Collection after a moment of faltering out. I believe it would be critical to leverage the European market, aside from launching 3DS. How do you plan on dealing with that? |

|---|---|

|

|

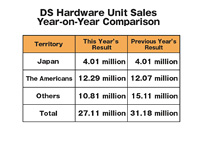

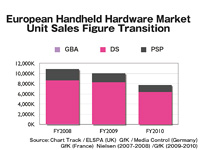

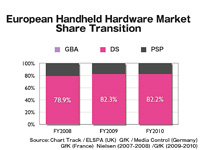

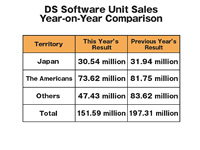

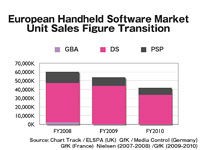

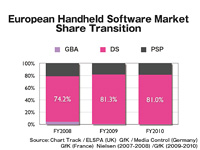

Iwata: In the Financial Statements, we are disclosing the same information about Nintendo DS hardware as the ones on the slide. This shows the number of sell-in from Nintendo, which include the stock at retailers; in other words, it can be called a shipment number. As you can see, the Japanese figures remained almost flat. U.S. made record results in the most recent fiscal year. On the contrary, “other territories” show sharp year-on-year declines by 28%. Then what about sell-through on the markets, not our sell-in? This is the sell-through result. This shows the sales transition in four major nations in Europe during these three years. Right one is the 70th term or Fiscal Year ended March 2010. FY 08 and 09 are nearly equal but it fell sharply in FY 10, by nearly 23%. Nevertheless Nintendo’s share in the handheld market has not shrunk. What has shrunk is the whole handheld hardware market in Europe. Our understanding is that it is due to shortage of hit titles, which we could find in home console market. In other words, the ratio of home consoles sales increased in the entire European video game market. But the Nintendo DS software business looks unhealthy to anyone. Japanese software has remained almost flat, U.S. was reduced by nearly 10%, and other territories were reduced by 43%. This is too large a reduction in a single fiscal year. Some of you may have seen media coverage like “R4 is to blame” or “Piracy using illegally-copying devices like R4 derailed the software market,” and we cannot deny the alleged influence. Europe has the second most serious piracy situation following Asia. But we should not blame it as the sole reason for that market shrinkage. We have also analyzed sell-through like this. These four nations show about a 23% decline in year-on-year Nintendo DS software sales in the markets on average. What happened to these countries? Please notice that in the midst of fiscal year ended March 2009, or fall 2008 to be more precise, the “Lehman Shock” occurred, followed by the global financial crisis and simultaneous economic slump. Before then, software makers and retailers were making aggressive orders to us based on the growth of the Nintendo DS market as a business opportunity. But the situation turned upside down, as I remember, since the beginning of 2009. Firstly, they significantly reduced orders. In reality, there were actually titles that had been shipped in the 68th term(ended in March 2008) and in the 69th term(ended in March 2009) but could not be fully sold through to the customers and kept at the retailers. They had to clear these stocks before making another big order. Our fiscal year ended March 2010 was significantly impacted due to such rapid shrinkage of retailers’ shipment orders. As for repeat order, I hear its frequency has not hugely changed and smaller ones are even increasing. In other words, when one title shows good sales, the retailers make small repeat orders, but they do not make aggressive orders, which come with risk. Then software makers followed that decision and software shipment shrunk. But I have to mention that 43% decrease does not mean that of total market. The 43% decrease is in Nintendo’s shipment. The decrease in the actual software sell-through in the market was only little more than 20%. Of course we cannot leave the situation as is. As we were able to rejuvenate the Japanese market, right now we are considering how and with which title we can rejuvenate the European market. Our understanding is that summer sales season counts a lot in annual results in European markets and we are making various preparations for that. As for portable software market share of Nintendo DS, it has also not changed a lot since last year, which means it is not only the matter of Nintendo DS. On the other hand, this steep fall cannot be seen other than in Europe. We are focusing all of our efforts in order to reach a solution and to make good reports next time. |

|

|

I want to ask your views on infrastructure and storage. Do you have any plans to expand “Nintendo Zone” at your own cost? In the future, with more Nintendo Zone and more proposals you want to deliver, there will surely be a need for larger storage. Will you be building the storage at your own cost, have one as a company’s asset, or put it outside the company in a way, unlike Google, everyone can sort of upload contents? |

|---|---|

|

|

Iwata: I believe there is an increasing importance for proposals like Nintendo Zone. As for the issue as to who pays, I would like to stay flexible on finding solutions. To take an example, if a store installed Nintendo Zone and therefore saw an increase in the customer traffic, and ultimately in their profits, the store would probably find Nintendo Zone beneficial enough to pay for the cost of Nintendo Zone. On the other hand, for some places where more attendees would not necessarily mean more benefit, like train stations in Japan, Nintendo Zone would not necessarily financially benefit rail companies, even if we at Nintendo thought Nintendo Zone is suitable for stations. In such a case we have to be flexible on dividing cost burdens. As for storage, as you mention, there will be many kinds of new opportunities in the future. Even though I cannot make a concrete comment on our future, at the very least I can say that this is one of the areas we are paying attention to. |

|

|

Mr. Iwata, how do you find the situation of video game industry this year, and where Nintendo stands among them? I have often been asked about IP protection issues by our foreign investors. If you have any data, how much damage have you received so far? Are you planning to apply any new countermeasure on the new 3DS? I have the impression that Wii has a very low tie ratio(*) compared to the past consoles. Do you see it inevitable as Wii is mainly purchased by casual players? Or, with three blockbusters now in the market, what kind of further approaches do you think is needed towards the core gamers? Will a new price strategy be necessary in order to further expand the casual population. Do you have any price strategy in this term or next term, aside from what’s written in the budget?

(*) Tie ratio shows how many software are sold per hardware.

|

|---|---|

|

|

Iwata: Firstly our view on industry situation is, in short, that “consumers are getting tired of any commodities much more quickly than before.” Across the video game industry as a whole, there is a strong trend that consumers get tired of various products in a shorter and shorter period. We at Nintendo have a relatively larger number of long-tail titles, but not all is going as we expected. As customers bore of products more rapidly, we have to be speedier to make proposals more than ever. And this is not only our problem but the entire industry’s. Video game market has traditionally been driven by small amount of hit titles. Even today, it has not changed that such hit titles will make customers feel eager to play it and buy consoles, which serves as an engine to drive hardware sales. Nintendo has continued to make efforts to make such proposals. Along with that, we need another method for new gamers to get excited again and again so that their consoles keep a high usage rate. As for tie ratio, it is an understandable idea because casual gamers account for the majority, tie ratio lowers. But I think that the situation has changed and the consumers are less frequently buying packaged software, playing it and buying another one, again and again. In other words, consumers today carefully consider before purchasing any product. Due to the effect of the internet, information spreads faster than ever. For instance, potential customers are exposed to so much information which makes them decide against buying it even though they had purchase intentions. After reading “do not buy” on someone’s review, their eagerness to buy suddenly disappears. Such an instance can happen much more easily and frequently, and the rate of casual gamers does not necessarily explain higher or lower tie ratio. If we use tie ratio as the only measure, I think there would be a larger gap between Wii and other platforms. But the truth is that there is no such significant gap. In that sense, I am skeptical against the view that Wii has a lower tie ratio because Nintendo tried to attract casual gamers. What we believe is important is to refine each one of our products as much as possible so that they can attract customers and look like it is worth paying money, and continue to consistently come out with continuous proposals, without too much of a lag from product to product. With regards to IP protection, I do not find a lot of meaning in calculating up the amount of damage due to piracy. While we may be able to calculate the damage by “number of downloads” multiplied by “their market value,” it does not necessarily mean that all the downloader had the purchase intention but quit due to illegal downloading. This calculation only gives us a virtual amount of damages, not the actual one in market. As I believe it’s not very meaningful to calculate them, we have not dug deeper and have no such plans to do so. Having said that, however, I understand how serious the piracy issue by illegal IP protect evasion is. Among many, what’s very problematic is that the piracy population is expanding. Those who had never thought of such an act are losing resistance to such deeds. Our worst case scenario is that they will gradually lose the reason why they need to pay for software. Recently a book called “Free” became a popular topic. It is said there will be a deflation for digital contents. As mentioned in the first question, Social Gaming is close to this tendency and can be treated as a form of contents deflation. In that sense, it can also be said that large amount of iPhone games, which are free or a dollar, is a type of content deflation. Under such circumstances, we are trying to figure out how we can keep the value of our entertainment proposals to maintain reasonable prices in market. In that sense, we have a very strong sense of danger for the expansion of piracy. Since a game hardware has to be designed to maintain the compatibility for all the dedicated software, once the protection in the hardware is broken, it’s not easy to upgrade(the protect system) as all the previous titles have to work even under the new system. Nintendo 3DS gives us such a chance, so naturally we would like to strengthen the protection. But please understand that I have to refrain from commenting on how we strengthen it, as it will give tips to those who are eager to evade it. All I can clearly comment is that we find the situation very serious and pouring much energy for the solution. |