for Fiscal Year Ended March 2014

May 8, 2014

This is the layout for a smartphone. This web service will enable more people to easily watch Nintendo’s official videos, view rankings, watch videos that their friends have shared and videos of tournaments in which they have participated.

As I mentioned at the Corporate Management Policy Briefing in January, our policy is to establish consumer relationships based on accounts named Nintendo Network IDs, which are abbreviated as NNIDs. This “Mario Kart TV” (temp.) web service is available even for players without NNIDs, but by logging into the service with an NNID, they will be able to easily find their rankings, videos that their friends have shared, videos of tournaments in which they have participated, and it will be convenient to access this service through smart devices even when they are not at home.

We will work on providing this type of service so that players can enjoy video games more and be in contact with them even when they are not in front of a video game system.

I have explained for the past few years that significant expansion of our digital business is essential to expanding our business opportunities, and the digital business of Nintendo platforms has expanded significantly in the past two years.

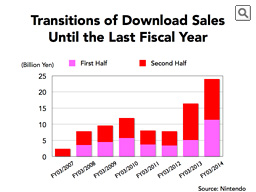

This graph shows the transitions of download sales until the last fiscal year.

As shown here, download sales had slowed down three-to-four years ago, but they have tripled in the last two years. I think this is because of the following efforts that we have undertaken in the past few years.

- Internet-connection ratios of Nintendo 3DS and Wii U are significantly higher than the past Nintendo platforms, and download-only games and services have been enriched

- Awareness of Nintendo eShop has reached a point where users periodically access it as a channel for video game information

- We started download sales of packaged software, which expanded our digital business

- We have expanded our range of payment methods, including POSA cards available in retail stores

In particular, when we consider that we have made this progress while Nintendo’s overall business has not generally been expanding, I think further developing this business will be imperative for us to adapt to the changes in the business environment.

Today, I would therefore like to explain another one of our approaches to expanding digital payment methods following on from the POSA cards available at retail stores.

In the Corporate Management Policy Briefing held in January, I explained about fully utilizing the NFC (Near Field Communication) function of the Wii U GamePad, and regarding this topic

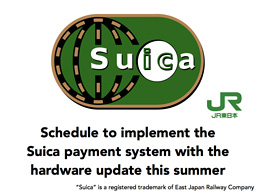

In this Financial Briefing a year ago, I mentioned that Nintendo was considering using JR East’s “Suica,” which is the most popular public transport e-money card in Japan, to make payments by utilizing the NFC function in the Wii U GamePad.

It has taken us some time since I first mentioned it, but we are expecting the payments with Suica to be possible with the hardware update this summer.

JR East has already made the interoperability with various other transport e-money cards possible on a wide scale, so Wii U will also support other transport e-money cards that are compatible with Suica, including PASMO and ICOCA.

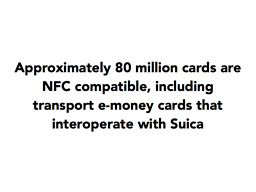

As of the end of March 2014, approximately 44.20 million Suica-compatible e-money cards have been issued, and approximately 80 million transport e-money cards in total have been issued that feature interoperability with Suica.

With this, Wii U will be the first video game console that has a transport e-money payment function and is connected to the Internet.

Wii U is still on its way to becoming a video game system that has spread among a large number of people, but even at this moment, there are 1.30 million units of Wii U in Japan connected to the Internet. I understand that approximately 250,000 shops where there are more than 450,000 machines that accept Suica at the moment, and I believe that the additional impact of more than one million units of a game console with an e-money payment system suddenly becoming available among families would not be so insignificant.

Until now, when making digital payments, consumers needed to use their credit card or take extra time to buy a pre-paid card, with which method, they have to charge a lump sum. However, the combination of NFC payments and e-money cards will make it much easier for consumers to make payments.

The e-money that can be utilized with the NFC payment function is most popular in Japan, so this function will first be tested in Japan.

On the other hand, compared to other countries, it is said that Japanese people are more disinclined to use credit cards on the Internet, and actual data shows that the usage ratio of prepaid cards is much higher in Japan than in other countries. From this perspective, we think that this NFC payment function will help provide more convenience to consumers.

And at the same time, I think that this will be an opportunity for both Nintendo and our business partners to come up with new ways to do business on Wii U.

While we are on the topic of the NFC function, I would like to share one more thing with you today.

In the January Corporate Management Policy Briefing, I talked about our policy of actively utilizing character IP.

Since then, even more people than before with license and other associated business proposals using Nintendo character IP have contacted us.

We are not at a stage where we can share the specifics with you today, but we are seeing possibilities in licensing character IP in areas Nintendo has never worked before. I expect to be able to discuss some of the details before the end of this calendar year.

On the other hand, our management policy of actively utilizing character IP does not only mean expanding the licensing business.

Generally, a licensing business earns licensing fees from companies that take risks to do their business. Therefore, it is highly profitable, but the impact on sales and profits is limited compared to the company’s own business.