Semi-Annual Financial Results Briefing

for Fiscal Year Ending March 2015

Oct. 30, 2014

Those who were elementary school students when “Super Smash Bros. Melee,” and “Pokémon Ruby” and “Pokémon Sapphire” were released have grown up and they are now 18 to 25 years old.

Our research in each part of the world commonly indicates that consumers between the age of 18 and 25 represent a large percentage of those who purchased “Super Smash Bros. for Nintendo 3DS” in the release period. It is approximately 30 percent in Japan, which is twice the overall average of Nintendo 3DS software, and has even reached 50 percent in the U.S. and Europe. This great momentum for the game in the initial stage was supported by this generation.

Thanks to “Super Smash Bros. for Nintendo 3DS,” consumers of this generation pay more attention to Nintendo 3DS and are likely to remember enjoying “Pokémon Ruby” and “Pokémon Sapphire.” We think this is why the pre-orders for “Pokémon Omega Ruby” and “Pokémon Alpha Sapphire” have been strong.

They are now old enough to pay for their own expenses. They can afford to buy Nintendo 3DS to enjoy both “Super Smash Bros. for Nintendo 3DS” and “Pokémon Omega Ruby” and “Pokémon Alpha Sapphire” if they choose, and they might encourage their friends to play it with them too. We therefore see it important to stimulate their latent demand in the year-end sales season.

Taking into account both the trend of pre-orders and the same-generation hypothesis, we anticipate that “Pokémon Omega Ruby” and “Pokémon Alpha Sapphire” to be released next month will have more sales potential than just another remade game in the industry.

A major factor in the decrease of sales of the Nintendo 3DS hardware in the first half of this year is that we could not release any million-selling titles for the platform in the Japanese market. However, the two versions of “YOKAI WATCH2” (Japanese titles) released by Level-5 in July have sold approximately 2.8 million copies in total including their download versions. In addition, the sales of “Super Smash Bros. for Nintendo 3DS” released in September are currently 1.88 million units and will shortly reach two million units including its download version. Furthermore, the sales of “Monster Hunter 4 Ultimate” have already exceeded two million including its download version in three weeks since its release in October (in Japan). Such a sequence of double-million sellers is due to the fact that each of them appeals to different generations.

“Pokémon Omega Ruby” and “Pokémon Alpha Sapphire” are on the way in November.

Seen in this light, in the second half of this year,

We can reasonably expect such a surprising outcome as four double-million sellers in no longer than five months.

Tracing the history of software for dedicated video game platforms since 2000, when we started to receive precise video game sell-through data in the Japanese market from independent research companies, the number of titles that sold more than two million units amount to seven for Nintendo 3DS, 15 for Nintendo DS, eight for Wii, two for GameBoy Advance, and regarding other companies’ platforms, two for PSP and three for PS2.

Four double-million-selling titles in five months is a first in the history of the Japanese video game market. It is almost certain that the three titles I introduced before will become double-million sellers in four months, which is also a first.

Furthermore, having three “million” sellers in four months is so rare, even though it happened three times for Nintendo DS (in 2005, 2008 and 2009) and Nintendo 3DS (in 2011, 2013 and 2014), that the other platforms have never experienced it.

It seems that the market status of video games for dedicated platforms is increasingly being reported as pessimistic in contrast with the popularity of smartphones. The facts I have showed here proves that dedicated video game platforms still have ample business opportunities. I might add that third-party titles developed by software publishers as well as Nintendo titles have produced significant results. It is true that the sales of video games have been globally polarized between huge hits and ones that do not sell well, but I would like you to know that some blockbusters have consecutively emerged in the field of dedicated video game platforms.

Here I would like to tell you about the current situation of New Nintendo 3DS and New Nintendo 3DS XL (known as New Nintendo 3DS LL in Japan), launched on October 11 in Japan in advance of markets overseas.

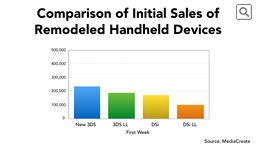

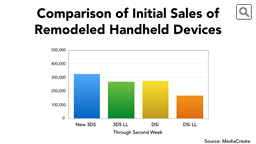

The sell-through results of the two models combined was 234 thousand units, which is the largest first-week sales of remodeled devices we have ever released. New Nintendo 3DS XL has been more popular and was out of stock at many stores. We are sorry about the shortage of supply.

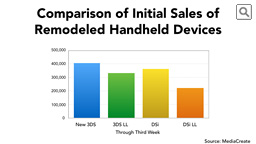

And third week. We feel that the new “super-stable 3D” function, new “C” stick, and accelerated CPU of the new models have been well-received by our consumers.

With the new models in addition to the consecutive release of games which could be double-million sellers, we are confident that Nintendo 3DS will establish a presence in the market in the year-end sales season in Japan.

Under these circumstances, domestic software publishers are eager to develop software for Nintendo 3DS. You can see a lot of titles here and I have also heard that there are many other unannounced titles to come.

Nintendo will also continue to enrich the lineup of software for Nintendo 3DS after next year.

When it comes to the overseas markets, we do not plan to launch New Nintendo 3DS/3DS XL for the U.S. or Europe this year. Additionally, there are only a couple of big titles, “Super Smash Bros. for Nintendo 3DS,” and “Pokémon Omega Ruby” and “Pokémon Alpha Sapphire,” overseas as no “YOKAI WATCH” franchises or “Monster Hunter 4 Ultimate” will be scheduled this year there. Based on these observations, some might wonder if, apart from the domestic market, the sales of Nintendo 3DS will really be able to gain momentum in the overseas markets.

The overseas markets are different from the Japanese market in both their stages of popularization of Nintendo 3DS and their market characteristics.

The stage of popularization of Nintendo 3DS means the degree to which we have turned potential purchasing power into actual sales of the product in a market. In Japan, the total number of sales of Nintendo 3DS has reached nearly 17 million in the three and a half years since its launch. It is almost the same as the lifetime sales of GameBoy Advance released in 2001, which implies that it is reasonable that the sales of Nintendo 3DS have been temporarily slow moving in the Japanese market. This is one of the reasons we needed to bring New Nintendo 3DS/3DS XL to the market this year. To the contrary, neither of the cumulative sales figures of Nintendo 3DS in the U.S. nor Europe is more than that in Japan despite, based on the historical performance, bigger sales potential. In short, Nintendo 3DS is still at an earlier stage of popularization in these two markets.

Also, the difference in market characteristics shows up in the software sales pace. In the Japanese market, both hardware and software tend to sell during a short period along with a quick spread of information on them. In the U.S. and Europe, on the other hand, highly acclaimed games are likely to be longtime sellers.