for Fiscal Year Ended March 2010

Jan. 29, 2010 - Presentation by Satoru Iwata, President

Thank you for coming to our Financial Results Briefing today despite your busy schedule. I'm Satoru Iwata, president of the company.

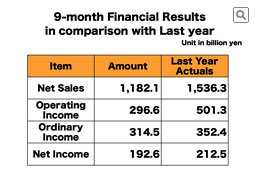

First, I would like to briefly explain our 9-month financial results.

The 9-month net sales were 1 trillion 182.1 billion yen, which shows a significant decline when compared with the net sales of the corresponding 9-month period a year ago. However, this was mainly due to the year-on-year decline during the mid-term and, when we look only at the 3rd quarter, the net sales for October to December 2009 were 634.1 billion yen while they were 699.4 billion yen a year ago. Given the significant appreciation of the Japanese yen against foreign currencies, specifically by 9.28 yen against the U.S. dollar and by 17.7 yen against the euro on average during the subject 9-month fiscal term, we feel that our business in the 3rd quarter, which includes the critical year-end sales season for the industry, has recovered to the level which is not significantly different from that in the previous year. Operating income, ordinary income and 9-month net income were 296.6 billion yen, 314.5 billion yen and 192.6 billion yen, respectively. The reason why the percentages of the decrease in ordinary income and net income were smaller in comparison to that of the operating income is because there was foreign currency exchange gain in the subject 9-month period, while a year ago, we had posted a large sum of the loss.

Given the significant Wii sales decline during the subject 9-month term on a year-on-year comparison basis through November, I would first like to talk about what happened in December in the three major markets of Japan, the U.S. and Europe, then about the final result of our overall business in the year 2009.

Let me first discuss the Japanese market.

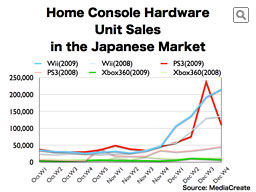

This graph compares the home console hardware unit sales during the October-December period on a weekly basis between 2009 and 2008. The sales of Wii have been showing rapid growth since the first week of December last year, when New Super Mario Bros. Wii was launched. The contribution of New Super Mario Bros. Wii software to the increase in Wii hardware sales must be obvious to anyone, but it was not the only reason. By having available a variety of attractive software of different genres and tastes for the year-end sales season such as Wii Fit Plus, Wii Sports Resort, Poké-Park, Dynasty Warrior 3, Tales of Graces, Taiko-no-Tatsujin and Momotaro Dentetsu, we think it prompted many to purchase Wii hardware based on the following thinking: "I've been thinking about purchasing Wii for sometime by now, and now that there are multiple Wii titles that I am interested in, why don't I buy it now."

As I have often explained to you, Wii has been maintaining a high number of "users per household." It must have been relatively easy for entire households to make a purchase decisions as Wii has a variety of different software, which could appeal to each and every member of the family.

When we look at the calendar 2009 year, due to slower sales in the first half, more than a 30% decline in Wii unit sales was observed in Japan in comparison to 2008. On the other hand, when we compare December figures alone, both hardware and software for Wii recorded the biggest unit sales in 2009 in the last three years. The actual growth was more than our original estimate, and thus we experienced a shortage of New Super Mario Bros. Wii since its Japan launch until the beginning of this new year. A number of Japanese retailers also ran out of the Wii console and Wii Remote inventories during the year-end & new-year sales season. We apologize to the consumers who wanted to purchase these products on the spot. This experience has left us a great deal from which to learn. Also, when you look at this graph and compare the sales transitions of Wii and PS3, I think you notice that the increase or decrease in one platform does not necessarily mean a decrease or increase in another.

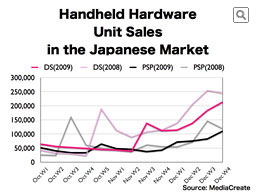

This graph shows the sales of the handheld systems in the same time period in Japan. In the Japanese market, ever since Nintendo DS established a significant installed base, handheld systems has held a more critical role in the market than the home consoles. When we just focus upon the year-end sales season of last year, the handheld market as a whole did not generate much excitement from the Japanese consumers partially due to the fact that consumer's attention was more focused on the hit titles available for home consoles.

By launching Nintendo DSi XL in Japan in November last year, we introduced people to a new size variation in the Nintendo DS franchise. Nintendo DSi XL was able to get off to a good start, and we have come to learn that Nintendo DSi XL has a market potential for a wide variety of consumers, especially those 25 years or older, as long as they can experience Nintendo DSi XL, actually see the bigger screens and hold a Nintendo DSi XL in their hands.

As I said earlier today, our consumers' attentions were focused upon home console video games during the year-end sales season. We do not think that the real value of Nintendo DSi XL has been fully communicated to potential consumers. We'd like to continue with our promotion activities so that our consumers will be able to appreciate the appealing characteristics of Nintendo DSi XL, and continue to further expand the Nintendo DS franchise.

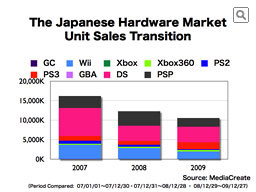

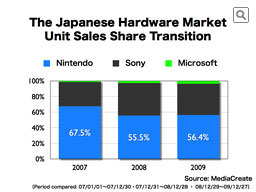

This graph shows the unit sales transition of all the hardware in Japan in the last 3 years.

As for Nintendo platforms, the unit sales of Wii in 2009 decreased slightly more than 30% compared to 2008, but Nintendo DS showed a year-on-year increase by a small margin. When we combine both of these Nintendo hardware, due in part to the lack of hit software titles in the first half of 2009 and to the fact that the whole video game market in Japan had slower sales, our combined unit sales result in 2009 was less than that of 2008.

When we look at the market share transition of the entire Japanese hardware market between the three hardware manufacturers, although it might be unexpected, Nintendo hardware actually expanded its share by a small margin in 2009.