Semi-Annual Financial Results Briefing

for Fiscal Year Ending March 2011

Oct. 29, 2010

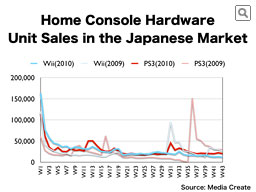

Based upon data from MediaCreate, this graph shows the home console hardware sales situation of the Japanese market.

Earlier this year, the market was able to show year-on-year increases. However, in comparison to last fall, when hardware price cuts and other factors stimulated the market, the sales in the most recent weeks were below those in the previous year. Our announcement earlier this month that next month we will change to a new Wii package, which includes the new Wii Remote Plus, must have something to do with one of its lowest weekly sales levels in the recent weeks since its Japanese launch.

Regardless of the reasons, the sales level is not good, and now that we are heading to the year-end sales season, the company must change the situation for the better.

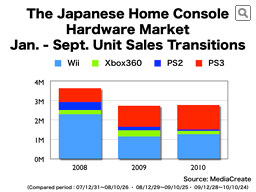

This graph compares the January to September unit sales of home console hardware in Japan from 2008 to 2010.

About a year ago, the year-on-year decrease in Wii hardware sales was much talked about. So far this year, slightly more sales have been realized than last year. PS3 also has shown a year-on-year increase so far. When we look at the January to September sales of this year, the Wii hardware market share was 46% and the PS3 hardware market share was very close at 45%. However, the year-on-year increase so far for both hardware consoles was largely thanks to the larger sales increases found earlier this year. And now, unlike last year, neither company is scheduled to launch a title which is expected to sell two million units or more. There is no room to be optimistic.

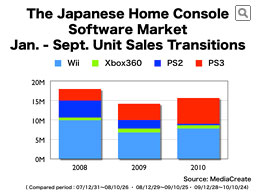

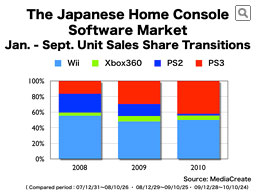

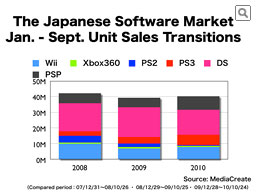

This chart shows the transitions of home console software unit sales in Japan.

The current Japanese market is smaller than that in the U.S. and in Europe. On the other hand, when we make a year-on-year comparison, this year so far has shown an increase, unlike the situation a year ago.

The share of Wii software increased to 50%. The increased share of PS3 software was able to almost cover the decrease in PS2 to reach 42%.

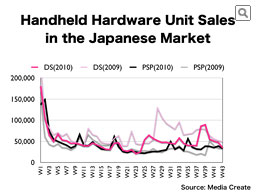

Next, let’s look at the Japanese handheld market.

This is the year-on-year comparison of handheld hardware. Since Nintendo DS this year did not have very strong titles that can be compared with “Dragon Quest IX” or “Tomodachi Collection,” (Japanese title) which were launched in Japan in summer last year, Nintendo DS hardware sales this year were decreasing until mid-September. However, we can note that the launch of “Pokémon Black” and “Pokémon White,” which have been selling at record paces since their launch, has positively affected Nintendo DS hardware sales.

In addition, when it comes to the shift in demand from existing products to newly-emerging ones, the Japanese market in general is the quickest of all the nations around the world, so we have to think that our announcement about Nintendo 3DS also has affected the sales of Nintendo DS.

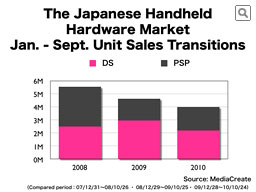

Let’s now compare the unit sales of handheld hardware devices from the beginning of 2008, 2009 and 2010 until the most recent week in each respective year.

As I just explained, since Nintendo DS sales were below their 2009 level until the latest iteration of the Pokémon series was launched, Nintendo DS hardware unit sales so far this year have not been able to outnumber those of the previous year.

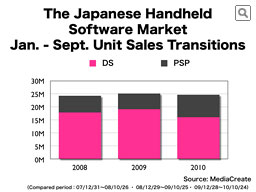

For the same nine-month periods of the recent three years, we will now compare the Japanese handheld software unit sales.

As I have already explained today, by the end of September in 2009, several hit titles were driving the Japanese handheld market. On the other hand, for this year, since Nintendo DS did not have any corresponding smash hit titles until the launch of “Pokémon Black” and “Pokémon White,” the sales so far this year are below the 2009 level. As for PSP, unlike the overseas markets, new titles have been launched one after another in Japan, and PSP’s sales so far this year are above its sales in 2009.

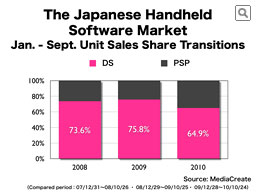

In such circumstances, Nintendo DS decreased its share in the Japanese handheld software market, which is very different from the U.S. and Europe, where Nintendo DS has been keeping approximately 80% or more of the market share.

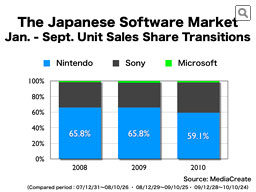

What you are seeing now is the transition of the entire Japanese software market, including both home console software and handheld software. Unlike a year ago, the Japanese software market showed a small year-on-year increase.

We are now comparing the software market share of three platform holders in Japan. With the decrease in Nintendo DS software sales and other factors, the software share for Nintendo so far this year is less than that of last year.