| |

You have a grand strategy of “gaming population expansion," and I would like to ask you about your targeted consumer base again. Naturally, the value of a product is to be judged by its users, and the key to growing a business and creating consumer demand is matching a product function to what is highly valued by users. What is the consumer base you are currently aiming at, and has it recently changed? Please let me know your view on your position regarding consumers. |

|---|---|

| |

Iwata: First of all, we would like to keep pursuing “gaming population expansion" as our fundamental goal for the future because we believe that it is worth continuously aiming at and that it will grow the market, expand our business and improve our financial results, which could give our shareholders much return. |

| |

The types of the users of the Nintendo 3DS must have changed since its hardware price cut. I assume that, initially, Nintendo fans and avid users purchased the hardware, and I would like to know what kinds of changes have taken place since the product became more affordable thanks to the hardware price reduction. Also, the Japanese software lineup includes “Monster Hunter 3(Tri)G" (Japanese title) which can appeal to a wider range of consumers, but in the United States and Europe, it appears to me that the two titles of “Super Mario 3D Land" and “Mario Kart 7" are standing out much more than other titles. Can I expect to see the strategy in these territories to appeal to a wider audience just as we are observing in Japan? |

|||

|---|---|---|---|---|

| |

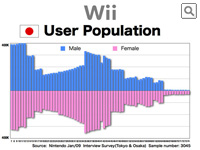

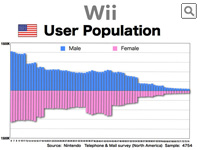

Iwata: First, just as you pointed out, it is true that the consumer demographic of the Nintendo 3DS has changed since the hardware markdown. To be more specific, at the beginning, the main consumers were those who could afford to purchase a 25,000 yen (the MSRP in Japan) hardware system at times other than Christmas, or namely, a number of avid male game players, who are earning a living and have relatively more disposal income, were making these purchases. Of course, many Nintendo supporters, regardless of age or gender, also responded to our offers from the beginning.

However, there still is an age group which shows less support for our offers in Japan, and they are male junior-high, high-school and college students. So, when you look at the age-demographic charts of our consumers in Japan, it looks like the back of a two-humped camel. Namely, there is a significant number of users in the children’s age demographic but a dint in the high-school and college student age groups and then the number of our consumers increases once again in the adult demographic. “Monster Hunter 3(Tri)G" must appeal with great affinity to that group of consumers, and I believe you can appreciate that. Now to your question of, “Will Nintendo be ok without a title that is the equivalent of Monster Hunter in the overseas markets?", I should first confirm that there is not such a dent in the U.S. and Europe. |

| |

Can I expect to see the launches of Nintendo 3DS titles from the overseas third-party publishers which are aimed at avid game players next year? |

|---|---|

| |

Iwata: As a matter of course, it requires more time to develop such titles. Since in Japan, the importance of software for handheld systems among the entire video game business is larger than that for home console software, handheld software is the main battlefield for Japanese publishers. On the contrary, for the U.S. and European publishers, software for home console game systems is the main arena. Therefore, putting a higher priority on spending development resources and allocating teams to the development of software for handheld game systems can be decided only after a decent market is created for the handheld hardware. If the Nintendo 3DS had been able to sell a lot more in the beginning, third-party publishers would have announced by now which software they would launch. But due to the slower-than-expected sales start, everyone was in a wait-and-see mode. The situation is starting to change, and (after they see the results of the year-end sales season,) there will be more changes from next year and beyond. |

| |

Looking from the outside, your company appears to have two challenges: One is, I feel that the company has less foresight for the new technologies and the needs of the public. As an example, I feel that 3D viewing itself does not have a great affinity with video games. Another thing is, I feel that the company needs to accelerate its speed at which you comply with the changes in the world. More specifically, the company has been unable to comply with the social gaming era. What is your recognition on this point, Mr. Iwata? (Note: At the Q&A session, Satoru Iwata asked for the clarification of the question, but since it is not helpful for the readers of this Q&A, that dialogue has not been included here.) |

|---|---|

| |

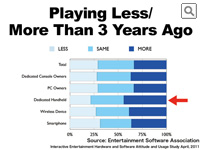

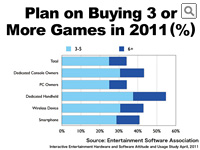

Iwata: First, regarding your question on the compatibility of games and 3D, please first play “Super Mario 3D Land" and “Mario Kart 7." I am looking forward to hearing your impression after playing these games. Of course, not 100 players out of 100 will say that 3D is wonderful. But we have confidence in these two titles, and we believe that majority of people will realize how 3D viewing can be used in video games. So far, as I have made these explanations based upon Nintendo’s own research, I was concerned that you might not feel that they have strong credibility. Accordingly, I would like to introduce you to some different data (which was reported to us from Nintendo of America) today. In the United States, there is an organization called the Entertainment Software Association or ESA for short, which is similar to what CESA (Computer Entertainment Supplier's Association) is in Japan. They are the industry body for a group of entertainment software developers. Every year, ESA conducts a survey regarding interactive entertainment hardware and software. What you can see now is some of their research results of this past April, showing whether or not people are playing more video games in comparison to three years ago. The darker blue represent the people who play more than three years ago, and the consumers represented by the lighter blue answered that they play less than before. The top bar labeled “Total" indicates the total number of people who answered this survey. There were about 1,300 people. The second bar, “Dedicated Console" means such home console game systems as the Wii, PlayStation 3 and Xbox 360, and about two-thirds of the total respondents fall into this category. The next bar is “PC" which most of the respondents own. The next one, “Dedicated Handheld," means such portable game systems as the Nintendo DS. The “Wireless Device" beneath it includes iPad and iPod touch (with which you can play video games by connecting the device to Wi-Fi networks.) The bar at the bottom, “Smartphones," are such devices as iPhone and Android. (Approximately one-third of the total respondents are included in each of “Dedicated Handheld," “Wireless Device," and “Smartphone" categories. Answers from the owners of multiple devices are reflected in each of the applicable groups.) In the same survey, another question, “how many software titles are you planning to purchase this year?" (as of April this year) was asked. Those who answered “three to five" are identified with light blue, while the dark blue answered “six or more." Once again, the owners of the “Dedicated Handheld" group intended to purchase the largest number of software titles. As I said, a number of dedicated handheld owners must also be the owners of home consoles. They are actively playing with both kinds of dedicated game systems. The survey result does not support the generally-conceived notions that, now that the digital age has come, people are buying less packaged software for dedicated video game systems and that they will be willing to buy less of them from now on. Overall, there is no doubt that the importance of digital business is increasing in the industry. However, the situation is not as simple as that the packaged software sales will decrease and digital distribution will increase or that the lifespans of dedicated game systems are coming to an end and general-purpose devices are the future. Our consumers are not showing such a trend. What the industry will look like 20 years from today may be a different story. But as far as the ongoing trend is concerned, I do not think that our understanding of the overall game industry and consumer attitudes is greatly different from the reality. I thought that the survey results I have just shown you could prove our point, so I used this opportunity to share them with you. |