Third Quarter Financial Results Briefing

for Fiscal Year Ending March 2013

Jan. 31, 2013

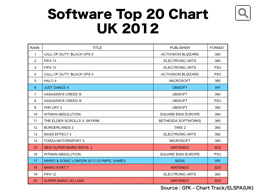

First let me show you the hit chart for the U.K. Out of all the major countries in which we operate, we perform least favorably in the U.K. market.

The U.K. market is the largest market in Europe but we only have Nintendo titles placed towards the bottom of the list, and Nintendo platforms have the least presence. Nintendo 3DS experienced the biggest year-on-year drop this year-end sales season, too.

This is for the Spanish market.

I have repeatedly said that a bad economy does not necessarily mean that entertainment options such as video games, which people can enjoy playing for a relatively long time with respect to cost, do not sell, and what is important is whether we can place our products at the top of people’s wish lists. However, as you can see from the report, in the country whose domestic economy is in such a crisis that no less than 60 percent of the people aged between 16 and 24 years old are unemployed, I do believe that economic circumstances had some effect on our performance.

Even then, Nintendo platforms are maintaining a certain presence, and we have 11 titles in the list. Also, you can see that the Nintendo 3DS titles are placed more to the top of the chart when compared with the U.K. market.

This chart is for Germany. There are 10 titles for Nintendo platforms, and in particular we can see some of the major titles for Nintendo 3DS having high positions, and we can also see that Wii still maintains a high presence in the market.

In the German market, platform transitions tend to occur slowly, but the transition from Nintendo DS to Nintendo 3DS is going rather smoothly, and in the year-end sales season, Nintendo 3DS increased sales at the same pace as in 2011.

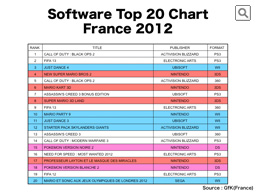

This is for the French market. There are 11 titles for Nintendo platforms, and as in Germany, some of the major titles for Nintendo 3DS are placed high, and Wii still has a large presence. Moreover, we have an entry in the Professor Layton series in the list, and although this one is not included, a title called "New Style Boutique" also known as "Girls Mode" in Japan, is selling quite well in France, and we see that the French market is one market in the West where Nintendo 3DS is enjoyed by a wide range of consumers and is steadily gaining more popularity. Because of this, France was the only market this year-end sales season where sales of Nintendo 3DS grew faster than they did in 2011.

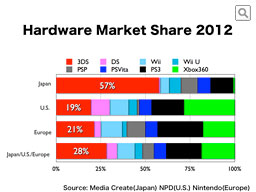

This graph compares the video game hardware market shares of Japan, the U.S. and Europe in 2012 that I just explained.

In Japan, Nintendo's hardware share is prominent. However, when we combine Japan, the U.S. and Europe, the overall share of Nintendo hardware is little less than 50% as you can see in the graph on the bottom.

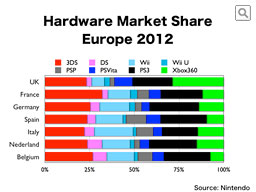

Also, Nintendo hardware appears to have comparatively smaller market share in Europe. On the other hand, when we look into the market share in each country...

They look like this.

The unfavorable situation in the U.K., which is the largest market in Europe, is contributing to lower Nintendo's pan-European hardware market share.

On the other hand, in France, Germany, Italy, the Netherlands and Belgium, Nintendo hardware occupies more than 50% of the market share, which is a bigger market share than in the U.S. There are even such countries like Italy where Wii is outselling other companies' home console machines. These graphs must better illustrate the reason why the software hit charts in each country show different sales trends.

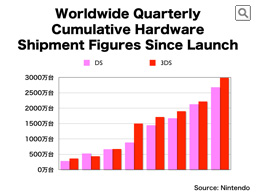

This graph has been created based on shipment figures that we announce every quarter in our financial announcements and compares Nintendo DS and Nintendo 3DS in terms of their quarterly cumulative hardware shipment figures. Nintendo 3DS has now passed its eighth quarter, but Nintendo 3DS continues to outpace Nintendo DS.

With Nintendo DS, we were first able to achieve considerable momentum in the Japanese market. The European market then followed, and the U.S. market, which is the largest of the three, was last.

I have just explained that in the Japanese market the Nintendo 3DS platform is already established as the market leader. On the other hand, however, we could not launch hit titles which could lead the markets towards the end of the year abroad and sales are largely behind our target overseas. This is one of the main reasons for our downward revision to our annual shipment target from 17.50 million units to 15.00 million units.

One explanation for not creating enough momentum in the overseas markets is that we have so far been unable to release hit titles other than the three Mario titles. In the domestic market, "Animal Crossing: New Leaf" became the great hit that it did, and software publishers have also enjoyed hit titles, meaning that we have a wide range of software to choose from, but in the overseas markets, Nintendo 3DS has not yet solved its chicken-and-egg problem as a platform. To put it another way, we do not yet have a virtuous cycle where hardware sales and software sales drive one another. Because of this, our lineup lacks diversity, and as a result, Nintendo 3DS does not have as wide and diverse an appeal as Nintendo DS. As a consequence, software sales, which should ideally grow in proportion to hardware sales, did not grow as expected.

In light of this, I think the problem boils down to how we can create in the overseas markets the same trend as in the Japanese market.

This problem did exist with Nintendo DS, which gained momentum in the order of Japan, Europe and the U.S. The U.S. and Europe certainly have much larger populations, so the market potential for us should be larger than the Japanese market. This year we will strive to bring out the market potential that we could not achieve last year.

On the other hand, sales of Wii U progressed favorably in the beginning except for the imbalance of supply and demand between the Wii U DELUXE SET and the Wii U BASIC SET. However, since we were unable to incite enough excitement in society, we have failed to maintain its momentum after the turn of the year.

In addition to this, because of some delays on the development side, we were unable to continuously supply software at the beginning of this calendar year. This has further upset our scenario for market penetration, for which momentum is the key.

While it was pointed out that, unlike in the case of Wii, it was difficult to instantly understand the appeal of Wii U, those who purchased it, although there are issues to be addressed, have shown a certain degree of satisfaction with our product value, but since its value by nature is something that takes time to appreciate and hence cannot be spread amongst society instantly, we have yet to communicate its value to the wider public. To put it another way, we delivered Wii U to those consumers who we thought would be the first to buy it, but information has not successfully been passed on to those consumers who we think will be the next people to buy it. This must be one big factor with which Wii U could not maintain its momentum.

People always try to compare the sales of Wii U with that of Wii, but the current situation is requiring us to focus upon how to reenergize Wii U sales irrespective of any comparisons with the previous platforms.