for Fiscal Year Ended March 2009

Jan. 30, 2009 - Satoru Iwata, President

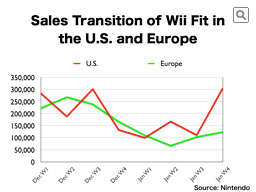

Let me talk about the sales transition of Wii Fit in order to explain the software sales.

In general, December is the month when the largest number of software is sold in a year, and software which launch at the end of a year show a significant decline in sales at the start of the new year. In the case of typical Nintendo titles, January sales are often 20 to 30% of the preceding December sales. Wii Fit, however, is clearly showing exceptional sales transitions. Last week in the U.S., more than 300,000 Wii Fit software were sold, which is an unbelievable figure with the year-end sales season already over. When we compare the 4 weeks in this January with the same 4 weeks in December 2008, American sales level of Wii Fit in January is more than 75% of December and Europe is keeping more than 40% pace.

As of the end of 2008, Nintendo already shipped more than 14 million Wii Fit. We are still expecting growth in Wii Fit Sales. Also, such other titles like Mario Kart Wii are showing continuous strength in sales in 2009.

As you have seen now, in the U.S. and in Europe which are the major business battlefields for Nintendo, our most recent businesses are healthy and doing well. However, some of you may say, “I understand the good prospect of the current fiscal year”, “What will become of the next fiscal year and afterward?”

Nintendo’s business has grown rapidly in the past three years. Can we maintain the size of the current business in the next fiscal year and beyond? Or, can we even expand the business in the years to come? These may be the questions that concern you most.

Some are thinking that what takes place in Japan becomes the future indicator for the overseas markets because the gaming population expansion progressed first in Japan. By pointing out the facts that DS sales pace was slowing down in the former half of 2008 and that Japanese sales of Wii did not have the same momentum as the U.S. and Europe have, some say that Nintendo’s Wii and DS businesses may peak out during this fiscal year.

I think it is true that new information penetrates through the Japanese market very quickly and that Japanese people tend to get tired of something new very quickly. It is also true that the population is smaller when compared with that of other major markets, so it is inevitable that the market starts to feel saturated earlier than others.

Due in part to such backgrounds, Nintendo launched Nintendo DSi in Japan last November, earlier than the overseas markets, to offer new proposals in order to make the switch from “one DS per household” to “one DS per person.” As a result, without preventing the overseas markets from losing momentum, we were able to reactivate the Japanese DS market.

Those who are concerned that Nintendo business may peak out this fiscal year and may shrink from the next year are also basing their concerns upon the past platform cycle theory. Especially in the case of DS, when you apply this five-year cycle theory to a platform that has been through its 5th holiday season since its 2004 launch, a concern that DS business may slow down in the next fiscal year may appear to be logical at first glance. Since technology continues to evolve, I do not think any hardware can enjoy eternal life. Someday, we will need a new platform for sure, and of course, Nintendo is always preparing for that. However, now that our customer base has expanded this drastically, we do not think it appropriate to conclude that past platform lifecycle theory can and should be applied to the current generation.

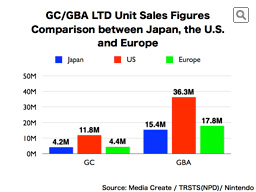

I think I have shown this graph before but this graph shows how GameCube and GameBoy Advance were selling before DS and Wii came along. In those days, Nintendo's marketing ability in Europe was weak. As a result, more than half of our sales were from the Americas, and the remainder, or little less than 50% of the total Nintendo sales, were almost equally made by Japan and Europe.

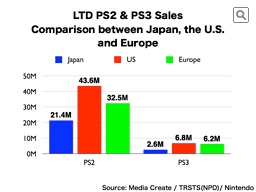

When we look at the cumulative sales of Sony's PS2, it reminds us that the U.S. has more than twice the market potential of Japan and, for Sony who was able to leverage upon the real market potential of Europe, the market size there is more than 1.5 times as much the Japanese market.

As these results date to the time before Nintendo embarked on its challenge to expand the gaming population, we can expect the market potential to grow even further. When we look at the PS3 sales in these markets, the gap between the U.S. and European markets appears to be narrowing down.

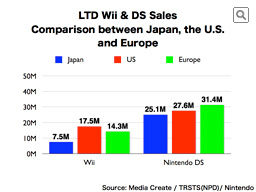

What we are looking at are the cumulative Wii and DS sales through the end of 2008. Wii has been selling at industry’s record pace so far, and with new customers acquired by the gaming population expansion efforts, it is not impossible for Wii’s total sales to exceed the final install base of PS2. Wii still has much more room for expansion. We can expect more sales of software in the next fiscal year than in the current year. With what kind of software is Nintendo going to achieve this goal? Well, it will be shown at E3 to be held in the U.S. this June.

On the other hand, when we look at DS, it is showing a rather unique development in each territory. This is due to the fact that the gaming population expansion by DS started in Japan, followed by Europe and eventually by the U.S., that there were significant time lags for the expansion to take place in each territory, and that the portable hardware market expanded very rapidly in Japan. The size of the Japanese video game market was originally about the half of the U.S., so it is rather unprecedented to see a similar amount of hardware being sold in Japan as in the U.S. The Japanese Nintendo DS business showed a slow-down in the first half of 2008. But, as you know, it is regaining its momentum with the launch of Nintendo DSi. And the time when DS business may see the saturation point in the U.S. and Europe appears to be far away from now. Additionally, we will launch DSi in the Americas and in Europe in the first half of next fiscal year in order to move forward to the next level of expansion.

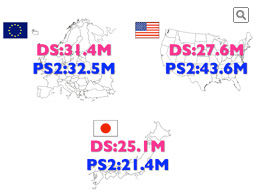

You are looking at the differences of life-to-date sales of DS and PS2 in each market. In Japan, DS’s sales have already exceeded that of PS2, and we are expecting the sales to further grow with DSi.

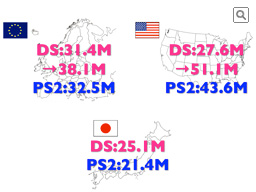

If we can assume that DS in the U.S. and in Europe can sell at the same ratio against PS2 as the Japanese market….

DS’s potential must look like this. Ultimately, a portable machine has the potential to have an installed base ratio of one system to every customer, so we can always expect larger sales than home console machines, which are owned by the entire family. In fact, more DS are being sold than PS2 in Japan, and DS sales in Japan are still growing. So, it won’t surprise me if the total sales of DS in the U.S. and in Europe will have largely exceeded the total installed base of PS2 in the future. Especially in Europe, where the size of the portable game market is going to expand that of the U.S., we can expect even larger potential than this.