for Fiscal Year Ended March 2009

Jan. 30, 2009 - Satoru Iwata, President

Thank you for joining our Financial Results Briefing today despite your busy schedule. I’m Satoru Iwata, president of the company.

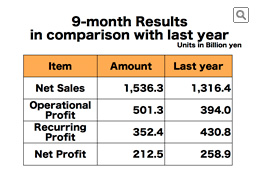

First, I would like to explain the gist of our 9-month financial result.

The net sales were 1 trillion 536 billion 3 hundred million yen. The higher appreciation of yen in comparison to the corresponding 9-month term a year ago had a significant effect in reducing our sales reported in yen by 184.7 billion yen. However, we saw an increase in sales because the Nintendo DS business in Japan regained its momentum due to the launch of the new Nintendo DSi, and both DS and Wii continued to perform well overseas. The operational profit was 501.3 billion yen, and along with the net sales, marked a record high for Nintendo’s 9-month financial results.

However, due to the significant appreciation of the yen since the global financial crisis in October, 174.2billion yen of foreign currency reevaluation loss was incurred as we reevaluated the foreign assets held in currencies other than Japanese yen. As a result, the recurring profit was 352.4 billion yen, and the net profit, 212.5 billion yen.

Next, let me explain about the revisions to the annual financial forecasts we made yesterday.

The sharp increase in yen’s appreciation has hit the entire exports industry in Japan. In the case of Nintendo where our overseas sales account for more than 85%, it is also not exempt from the significant impact of the strong yen.

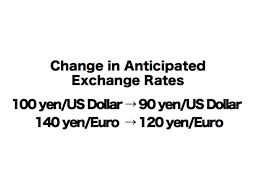

Following the most recent trend in the foreign currency exchange market, we have revised the anticipated rates at the end of this fiscal year to 90 yen per U.S. dollar and to 120 yen per Euro.

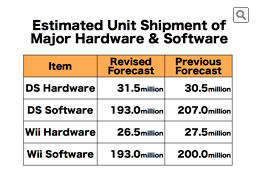

We have also revised the unit shipment forecasts of major hardware and software. As for Nintendo DS hardware, because the Japanese market started to regain its momentum due to the launch of new Nintendo DSi, and because the overseas sales moved favorably during the most recent year-end sales season, we are expecting 31.5 million annual shipment, which is 1 million units more than the previous forecast. As for Nintendo DS software, based on the more conservative approach than our estimate in October last year that our third party partners are now indicating to us to take with their expected orders to us, especially in the overseas markets, we have revised accordingly the annual shipment forecast from the previous 207 million to 193 million. As for Wii hardware, sales showed continued momentum in Europe and in the Americas but the Japanese domestic sales were less than our October 2008 estimate, so we have revised the shipment forecast from 27.5 million to 26.5 million. As for Wii software, in accordance with the decreased hardware shipment, and because we have heard that the overseas third parties are taking a bit conservative approach similar to DS software, we have revised the annual shipment forecast from 200 million to 193 million.

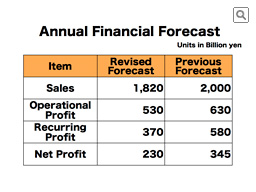

Because the annual financial forecasts are significantly impacted by the changes in the anticipated foreign currency exchange rates, we have revised the annual sales forecast to 1 trillion 820 billion yen and the operational profit to 530 billion yen. Since we are anticipating to incur foreign currency reevaluation loss when we reevaluate the assets and liabilities that we hold in currencies other than Japanese yen without forward exchange contracts, we now anticipate the recurring profit to be 370 billion yen, and as a result, the net profit to be 230 billion yen for the fiscal year.

So, due to the rapid rise in yen’s appreciation, we are now anticipating lower results than the ones we announced the last time. However,….

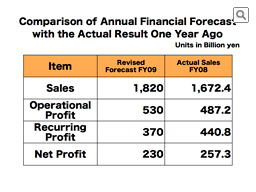

When we compare these revised forecasts with the actual annual results of last fiscal year, we are still anticipating increased sales and operational profit. Our forecast to record historic sales and operational profit has not changed.

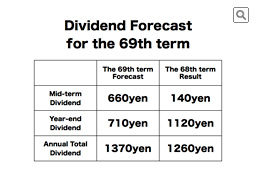

Given our revised financial forecasts and based upon our dividend policy, we anticipate the dividend per share as you see in this slide. Between the cases where 50% dividend payout ratio is applied and where 33% of the consolidated operational profit are the dividend resource, Nintendo chooses the higher one in order to pay the dividend. As we are anticipating foreign currency reevaluation loss due to the stronger yen, we are here applying our policy to use 33% of the consolidated operational profit as the dividend source, not the 50% dividend payout ratio.

When we compare the new forecast with the previous one we made in October, the year-end dividend amount is less. However, the actual annual dividend in the previous fiscal year was 1,260yen per share. In other words, we are anticipating to increase the annual dividend which shall be the highest ever annual dividend for Nintendo.

One of the main reasons why I decided to attend this financial result briefing today is to explain to you Nintendo’s prospect amidst the drastic changes in the business environment that was triggered by the global financial crisis. But before doing so, let me explain the comparison between the 4th quarter of last fiscal year and this fiscal year’s 4th quarter, which can be calculated by subtracting the 3rd quarter results from the annual financial forecasts.