|

|

Nintendo has been focused on expanding its Wi-Fi spots. How will you expand this in Japan and overseas? |

|---|---|

|

|

Iwata: Nintendo and McDonald's started a service called "Nintendo Zone" from June 2009. If you bring your Nintendo DS to one of the McDonald's restaurants in Japan, it can be connected (with the Wi-Fi available there) without any special settings. Setting up wireless Internet connections can be challenging, even when you have a wireless router in your home, and especially when a PC dealer sets up the net connection of the PC for you that you newly purchased, as you often have to deal with SSID and passwords, which can be confusing. So, some of you may find it unexpected, but getting a net-ready device connected to your home's internet is not very easy. However, you can bring your portable Nintendo DS anywhere you go. When people bring Nintendo DS out of the house, the rate of actual usage for Nintendo DS increases and have various other positive effects. Because we could anticipate positive results for both Nintendo and McDonald's, we have collaborated to start this Nintendo Zone service. Technically, it is feasible to expand the Nintendo Zone to other areas. If we can increase the places where Nintendo DS owners can enjoy internet connections, we feel that more and more people will be able to enjoy the same experiences, so we would like to expand these opportunities. In fact, we have been receiving a variety of different offers, some rather dynamic in size and some very local, and we are evaluating and experimenting them now. I think we will be able to provide the details of some of these projects in the future. Although we started the Nintendo Zone service in Japan, we believe in the possibility of doing something similar in the U.S. or in Europe. Although I am not in a position to explain today such details as which partners we are in discussion with, we are, in fact, having talks with several potential partners. Perhaps, we will be able to disclose some progress in the future. To confirm, the value of preparing wireless spots outside the households is that we are able to create an environment where people can get their Nintendo DS with the Internet without any special set up, which will show a different penetration from how wireless routers are making their ways into the households. It is important for us to encourage consumers to actually experience the advantages of being connected to the Internet as well as for others to observe how Nintendo DS owners are enjoying the internet connections. |

|

|

I had concerns in October and November last year, but because December (sales of Nintendo products) was reignited, I'd like to once again commend Mr. Iwata on having made an accurate forecast. Whether this fire of December sales is a candle light or a fire from gas burner remains to be seen depending upon the future lineup. When you said during the presentation today that the full disclosure of the 2010 year-end season lineup have to wait until E3, I had a feeling that you might be betting on early 2010 by expanding the sales of New Super Mario Bros. Wii, Wii Fit Plus and Wii Sports Resort, and that the real challenge will be in the latter half of the year. What kind of strategy are you conceiving during the former half and latter half of the year? Also, I think you said during the last briefing that you were interested in the Kindle. I happen to be reading a book called Free (by Chris Anderson) now. Your company policy is to most likely offer value which is worthy of its price. What is your opinion on the business possibility of the models introduced in Free in terms of SNS and countermeasures against illegal copies? I did not hear your remark about the newly emerging countries but only heard your message about being more interested in the expanded possibility of the developed nations, so I'd like to know about this point as well. |

|---|---|

|

|

Iwata: As a matter of fact, I myself was worried in October and November. Any corporate president must be concerned in a situation like that. Originally, we had expected that from around mid-November, the market would respond more strongly. We had done whatever we needed to do, and we knew that our consumers' satisfaction levels of our products were not bad at all. On the contrary, weekly sales did not show the usual increase of an annual sales pattern. I do not intend to pretend like an arrogant person and say that everything was just as I had expected. The fact is, we were concerned. When we see the results now, I feel that we have learned another lesson. We were able to observe how consumers react to our offers when there is no rush. More specifically, what probably happened in the U.S. and in Europe in 2007 and 2008 was that many consumers thought that if they did not purchase a Nintendo DS and/or Wii early enough, they will run out when they really need to buy them. Also, the economic environment was not this bad at that time, so they could afford to make a purchase decision early on. In case of 2009, their sentiment must have been that, because there were no dangers of the inventory shortage, they should wait to choose the best deals (from the retailers.) Fortunately, many consumers kindly chose Nintendo products in the end. We can either say that this was because Nintendo had been making efforts so that consumers would choose our products or because we were blessed by a tail wind at the very final stage. Having said that, however, we have not thought of it as the final glow of a candle light at all. Now that we have been able to once again learn about under which conditions consumers make their final purchase decision and make an actual purchase, we would like to continue our efforts while there is still momentum. Also, as I said earlier today, the situation of the Wii software market today is completely different from what it was a year ago. New Super Mario Bros. Wii was able to sell more than 10 million units in such a short period of time but the sales pace has not significantly slowed from the beginning of the New Year. It is still selling at a pretty good pace today and is the trend across Japan, the U.S. and Europe, so the software must have the potential to appeal to even more people as long as we can drag out its real potential. For example, New Super Mario Bros. Wii has sold more than 3 million units in the Japanese market where little less than 10 million Wii hardware units have sold. In comparison, if I remember correctly, NPD reported New Super Mario Bros. Wii's U.S. sales at the end of 2009 as approximately 4.2 million units. Because Wii's installed base there is about 27 million, about three times as much as in Japan, when we compare the U.S. software sales ratio to the hardware, even though 4.2 million unit software sales is nothing to be sneezed at, it has a long way to reach the level in Japan. Looking from such a perspective, we see further room for sales expansion. When a game can be discussed as a social topic, and when potential consumers can often hear positive comments on the game from people, the little interest they may have today can be peaked, and they may become willing to buy one for themselves. The important thing for us is to create such an environment. For your information, the software lineup I shared with you today includes those that will be launched in the first and latter half of the year. I would like to announce the launch months but cannot today as we are currently doing the final review and considerations. I am not saying that all the software which I mentioned today will be launched in the latter half of the year. Of course, we do not want to cool down the current momentum. We do not think it was a smart approach for us to launch all three (much-anticipated) titles in the latter half of 2009 in order to force the re-ignition of the market. Rather, it is necessary for us to prepare a well-balanced software lineup, which can be launched in a balanced manner, in order to maintain the momentum. Also, when I said that I was interested in (Amazon's) Kindle, I meant that I was interested in the business model where the consumers do not pay the costs directly to the (cell phone's) communication carriers even though the Kindle is actually making use of 3G cell phone network. When you make use of cell phone network, you are able to provide your consumers with devices which can be connected (with the Internet) all the time. Today, you can purchase 3G modules at a cost that is not too expensive, so the manufacturing costs are not regarded as a big issue. On the other hand, until now, communication carriers all around the world have been pouring enormous amounts of capital investments, and we have to make use of them. For video games, the users will probably need to pay several thousands of yen every month in order to use a lot of packet communications needed to play the games. I do not think a business model that demands our consumers to pay 5,000 yen every month for two years after purchasing a new hardware would be accepted. So, unless a smart business model, such as the ones implemented by Amazon, can be invented, there will be difficulty. The business model of Kindle can work because they are specialized in downloading a fairly compact size data (i.e., e-books). On the other hand, we have to wait to see some breakthrough in innovation in order for the game players to be able to compete in a video game on Wi-Fi communications in unlimited time period by consuming so many packets without having to pay the associated costs. With these backgrounds, I said that it was not something that we can do today but that I was interested in the business model of Kindle. About the book Free, I happened to read it myself. While many things are coming closer to free-of-costs in the digital world, there are pros and cons on the contents of Free. As Malcom Gladwell, author of The Tipping Point, posted his counterarguments to Free on the Internet, there are skeptical opinions about the future direction described in the book but, at least, I acknowledged that many things can easily lose their values in the digital world so we have to be very careful. In fact, many people believe that lowering the price is an easy way to sell products, and price reduction is often discussed as an option when they try to obtain short-term profits. Because I am concerned that, if we lower the price of the software without regard to the real value, then we will be lowering the value of the software to the extent that there will be no value remained and no decent business would be conducted anymore, so I have no intention to reproduce what is written in the book Free as they are. On the other hand, if we can smartly take advantage of the idea of Free, there is a potential that those consumers who were not able to try out products could have the opportunity to really understand their value, and it might be something that everyone should think about using. I did not spend time to explain today about emerging markets. In this climate where the Japanese domestic demands are not yet recovering and the Japanese population is estimated to decrease even further, I accepted some interviews with Japanese newspapers at the start of this year. At that time, everyone asked the same question about our plan for newly emerging countries. In return, when I asked them the question, "Why do you all ask the same question about newly emerging countries," they responded by saying, "It's because every company president (whom they interviewed in the New Year) insisted on the importance of the newly emerging countries from now." I agree that newly emerging countries are important because the size of a business can ultimately be determined by the size of the population. When we look at a 5- or 10-year range, whether or not we will be able to expand our business in the newly emerging countries decides our future growth. Simultaneously, however, I have to wonder how many of these people who are insisting on the importance of the newly emerging countries for their future businesses have been able to find the sweet spot in order for their products to be accepted by local citizens. Needless to say, each country has its own lifestyle and different infrastructure for information to spread. What one person is interested in varies in each person and in each society. People in different society tend to show interests in different topics. Nintendo has been able to show certain results as you are noticing today by selling identical products to people around the world, and it must be because we have been able to somehow appeal to something that can be appreciated by some common substance that we share as human being regardless of culture and race. However, that does not mean that we can apply the exact same communication methods we are using in Japan to the U.S. and Europe. We definitely strive to make sure our messages can be received and comprehended by people living in each country. During the process, we try to think very hard about how our messages could be conveyed, how we can make them interested, and how we can create the motivation for consumers to purchase because we believe these answers can be critical points for us to emphasize in the end. If, for example, we could identify the critical points for Indians, or Brazilians or Russians or the Chinese to appreciate our products, I would have told you today on which country we will be focusing this year. Even as we continue our research, I do not yet have the assurance as to what are the critical points or which critical issue needs to be solved. Simultaneously, I still think there is room for expansion in such existing markets as Japan, the U.S. and Europe. There still are a number of people within the yellow and pink categories in the graph today. There are a number of people who have yet to start playing video games, and as I showed you in another chart of social acceptance of video games, there are a number of people who do not like or don't know about, or even dislike video games. As long as we can change the circumstance(of the social acceptance of video games), we should be able to make more changes(for the better in developed markets). But, if I abandon such a possibility and say that the newly emerging markets are the only future, I felt I would be too irresponsible, which is the reason why I did not emphasize them today. Once again, however, we are not making light of newly emerging markets when we look at them in a three- , five- or ten-years range. Thinking about the combination with the model of Free might be one of the options. |

|

|

I really love to read "Iwata Asks" on Nintendo's website but have to admit it's not well known. Have you considered introducing it on a public occasion like today? After the third quarter, I think your challenges have become clearer. The largest one must be the DS software in Europe. Even though the 57% drop in your shipments for October to December quarter in the "Other Territories" may not be the accurate indicator of the actual sales in Europe, according to your explanation, the retail sales have actually dropped in Europe. How are you going to tackle with these urgent challenges? I find third-parties are falling behind after you successfully made party games a phenomenon which focuses on expanding the gaming population. Do you have any technological or marketing solutions that you can offer? |

|---|---|

|

|

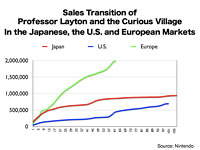

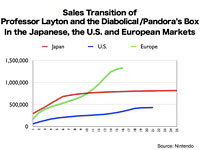

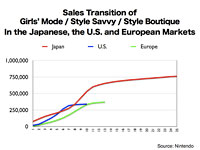

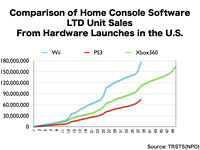

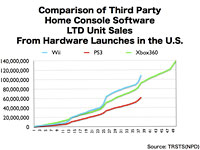

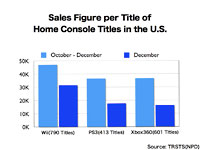

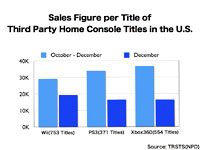

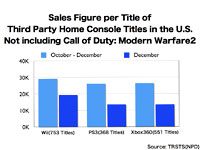

Iwata: As for marketing "Iwata Asks," I don't believe it's ideal for me to advertise it, but would appreciate any support from you. On to our challenges on the decline of our software shipment in the "Other Regions" including the European market, we acknowledge it as a big issue because, even though the decrease in actual sales in the markets was smaller than the decrease in our shipments (as I said during today's presentation), the actual sales declined about 20%. Some say it is due to piracy activities made possible by devices such as Magic-Coms(R4), but I don't believe it's the only reason. When Nintendo DS was getting more and more popular and sales figure performed accordingly, some of our product proposals became a social phenomena. Just like Brain Training in Japan, Nintendogs or Brain Training did the same thing in the European market. Actually Brain Training performed fine there last year - it sold over a million copies in Europe but the previous year had sold more than three million copies. That means Brain Training had less visibility as a social phenomenon last year. Nintendogs is in a similar situation. If we could propose what will replace them and maintain a high visibility in society, then the Nintendo DS momentum can be activated and more software titles can be sold. What this means is that we were not able to do that. Thus I believe our highest priority is to propose and offer Nintendo DS titles which can be another social phenomena. Professor Layton and the Curious Village (developed by LEVEL-5 Inc., and published by Nintendo in the overseas markets) is selling well in Europe. This chart shows the sales transition until two weeks ago. The local subsidiary reported to us that its (life-to-date) sales figure reached two million. Even though selling two million copies is actually a great milestone, it's much smaller than the sales figures of Nintendogs and Brain Training and not eve close to becoming a social phenomenon. Also, its influence on driving hardware sales by driving consumers to purchase hardware to play the software or revitalizing a number of Nintendo DS sleep users has not yet made it a social phenomena about which newspapers write up. The second version of Professor Layton (Professor Layton and the Diabolical / Pandora's Box) is also performing very well. Life-to-date sales figure in Europe is over 1.3 million units and there's still room for growth. We also introduced Rhythm Heaven in Europe and the Americas, but regrettably it did not perform as well as we had hoped. We also released a Nintendo DS title called Girls' Mode (Style Savvy in US or Style Boutique in Europe). We cannot yet call it a title with the great sales but it's actually selling to some extent as you can see on this slide. Life-to-date sales figures are still lower than the Japanese results, but when we look at how it launched... it was much worse than what happened in Japan! Most of such slow-starting titles end up with bad results. Actually I was very shocked when it was reported to me that initial European sales were only 5,000 units in its launch week! To say it another way, it was due to the great efforts of our local staff that was able to bring a title with initial sales of merely 5,000 to such a high level. Current sales figure on the slide may look stagnating but it's due to lack of inventory. In fact due to its not-so-brilliant debut, not many retailers placed second orders. Since the year-end sales season its performance started to improve dramatically, and the consumers who bought the title have given us feedback like "I'm extremely devoted to it because it is so good." European retailers and consumers were a bit biased about girls-oriented titles as there had been a number of similar girls-targeted Nintendo DS titles in overseas markets. Now that we have established a basis to introduce the value(of Girls' Mode/ Style Savvy/ Style Boutique), further growth is, I believe, in sight. Moreover, what is most important is to make what can really become socially recognized phenomena. Of course, it is a fact that piracy activities in the European market including devices like Magic-Coms(R4) are large concerns for us. As I have mentioned before, we will continue to confront it with legal and technological measurements. Another topic that I have addressed several times is the opinion that third parties can't perform well on Nintendo platforms." During the previous fiscal result briefing, I had shown some data to explain that it was not true, but it seems a hardened belief cannot be altered easily. Or you might see the situation from such a viewpoint because of the visibility of Nintendo titles on sales chart. So I would like to show you an analysis from a different angle here... this is the life-to-date software sales figure I just showed. When we pick up just the third parties, it will look like this. In the earliest days of Wii, of course software companies could not have predicted what would happen on Wii, so their (third party software) performance was not strong. After they decided to focus on releasing Wii titles, then the sales started to improve from the second year and, this is the current situation. On the other hand, as not so many of their iconic titles could come out on Wii as huge hits, it creates an image that third-party titles aren't performing well since we can find few of them on the Top-10 software sales chart. But when we gather the total sales number – like this NPD number, which tracks every title's sales – the situation looks quite differently. Let me also talk about this from another angle; this chart shows the average sales figure per title on the three home consoles, according to NPD data. Total software sales on Wii from October to December were 37,193,384 copies, and during December it was 24,917,650 copies. If we divide this figure by the number of software titles which are subject to research by NPD (790 titles, which NPD tracked if is sold more than one copy during the period), it will look like this. At the same time, the same average on Sony's PlayStation 3 from October to December was 15,090,380 and during December it was 7,281,459. The number of titles subject to track by NPD was 413. On Xbox 360, it was 22,026,671 from October to December and 9,763,068 during December, with 601 titles subject to track. When we explain the situation like this, there must be someone who counters that it's not fair at all unless we remove Nintendo's great-selling titles. So if we remove first-party titles from each platform, it would look like this. At this moment, you may think that other platforms have better sales situations, or Wii platform is harsh for third-parties; In fact, however, Wii has a much larger number of software titles and so average sales figure per titles look naturally worse. But during the last year-end sales season, I believe there was one thing we have to specifically consider. It's Call of Duty: Modern Warfare 2, a great hit from Activision released in November for PS3 and Xbox 360. Its influence and impact might be as large as our ten-million trio(Wii Sports Resort, Wii Fit Plus and New Super Mario Bros. Wii). So when we remove it from the result, you will see this. The reason why the number of titles decreased by three was because NPD tracked three different SKUs for the game, namely, normal edition, pre-stage edition and special can-package edition. I think that's one of the aspects of big titles' impacts. In recent video game software market, there is a huge gap between what sells very well and what sells very badly and this is a challenge for the whole industry. Some people criticize that Wii business has been driven only by Nintendo's great hits and there is little benefit for third parties, which in fact is not true, as the situation is similar even on non-Nintendo platforms, when we compare per-title sales figure like this. Adding to these facts, when we actually consider which platform owns more major titles of third parties, that criticism again loses the basis. But once people assume a fact they can hardly pay attention to the contrary bases. So I believe we need to ask foreign software companies for their cooperation by asking them to pay close attention to these facts and by explaining the business opportunities on our platforms, in order to build a cooperative relationship. I must admit we did not make enough effort to solve the bias or misunderstanding between third parties and us. I believe we have to make effort to make them understand that we can build a win-win relationship on Nintendo platforms with their good software titles that hold plenty of opportunities. |