The main questions from the shareholders who attended the shareholders' meeting and the answers to these questions are below:

|

|

Does Nintendo have any directors with compensation of 100 million yen or more, which must be disclosed from this year? |

|---|---|

|

|

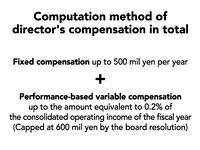

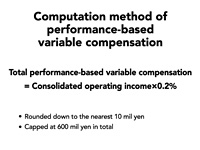

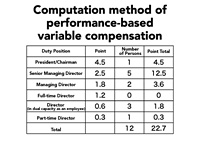

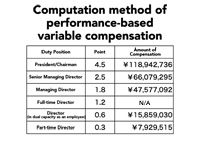

Satoru Iwata (President, Chairperson of the shareholders' meeting): Regarding the compensation to directors and auditors, it was only necessary for the Japanese listed companies to disclose the total amount paid. Starting from this fiscal year (ended March 31, 2010), companies are required to disclose the names of its directors and auditors with the annual compensation of 100 million yen or more in the annual securities report. For Nintendo, six representative directors will be listed on the 70th annual securities report: Mr. Iwata, Mr. Mori, Mr. Hatano, Mr. Takeda, Mr. Miyamoto and Mr. Nagai, and I, Satoru Iwata, was the highest paid, receiving 187 million yen. Although I have already answered this question from a shareholder, let me supplement how this was determined for reference. Three years ago, in the 67th Annual General Meeting of Shareholders, it was approved that compensation payable to directors consists of fixed compensation and performance-based variable compensation: fixed compensation of up to 500 million yen per year and performance-based variable compensation of up to the amount equivalent to 0.2% of the consolidated operating income of the fiscal year. Fixed compensation to each director, which is determined by the board of directors, basically reflects his duty position and the contribution he has made so far. The total amount of the fixed compensation for the 70th fiscal year was 415 million yen. The highest fixed compensation of all directors is 68 million yen per year to the president. The fixed compensation is divided into 12 equal parts and paid monthly to each director. As for the variable compensation, as I just explained, it is performance-based and the maximum amount is up to 0.2% of the consolidated operating income. The board of directors also voluntarily decided that the performance-based variable compensation should be rounded down to the nearest 10 million yen and capped at 600 million yen. The rounded-down amount, which is equivalent to 0.2% of the consolidated operating income of the 70th fiscal year (356.5 billion yen), was 710 million yen, which exceeds this voluntary ceiling. The total performance-based variable compensation for the 70th fiscal year, therefore, resulted in 600 million yen. Our annual securities reports have shown specifically how the determined performance-based variable compensation is allocated to each director, but please let me explain about this in detail. Each duty position is assigned points based on its responsibility. The determined performance-based variable compensation is allocated according to the points. The point total for all of 12 directors was 22.7 for the 70th fiscal year and, for example, the president received 4.5 points. Therefore, I, as the president, am entitled to 4.5/22.7 of the total amount of the performance-based variable compensation. This slide shows the allocation of a total of 600 million yen to each duty position. Please note that small adjustments were made in order to avoid showing the fractions. Directors receive the calculated amount of performance-based variable compensation as an executive bonus after the conclusion of each year's Annual General Meeting of Shareholders. The six representative directors receive compensation of 100 million yen or more by means of the above-mentioned formula. Let me also add that Nintendo abolished the retirement benefit system for directors and auditors at the 65th annual general meeting of shareholders, and does not have non-cash compensation such as stock options for directors and auditors. |

|

|

Nintendo's stock price, which once surged above 70,000 yen, has recently plummeted to around 26,000 yen. Do you have a plan to boost this? |

|---|---|

|

|

Iwata: We understand that stock price is one of the major matters of concern to shareholders as well as a widely-recognized barometer of corporate value. Naturally, in our roles of top management, we are always aware of Nintendo's stock price. On the other hand, it is also true that management cannot say what our current stock price should be because stock price is majorly impacted by investor valuation and the market environment. Speaking of the recent fluctuations of Nintendo's stock price, the announcement of Nintendo 3DS on March 23 drove it up and it reached 33,000 yen in early April. In May, however, the financial crisis in Greece led to a weak euro. Investors were afraid of Nintendo's future business with large sales in euros and the stock price of most exporting companies, including Nintendo, sharply declined. The Nikkei Index also moves below the 10,000 yen level these days, though it was about 11,400 yen in early April. We believe that Nintendo's sound business development in the mid-and-long term will basically benefit all of the stakeholders. In other words, we need to regularly release products that can offer positive surprise to our customers and to try to make efforts to spread that meaningful surprise in order to maximize the number of our consumers who are willing to purchase our products. We should be responsible for solid results in every fiscal year in order to not have people worry about our future by saying that Nintendo's rapid growth through Nintendo DS and Wii was just very lucky and nothing but temporary. If we can have our shareholders acknowledge in mid to long run that pure luck alone could not have yielded the actual sales results of Nintendo DS and Wii and that Nintendo is the corporate organization which has the ability to sustain such performances, it will dispel the concerns about our future business and, as a result, lead to a high valuation by investors in the long run, I believe. For the time being, we are concentrating on our new hardware, Nintendo 3DS, because it is very important to make Nintendo 3DS as popular as, or to make it more popular than, Nintendo DS which has been appreciated by so many people around the world. Of course, we are not focusing on just the new product that we have announced. For Nintendo DS and Wii which already have well-established installed bases, we are aware of the significance of developing quality software to continue to enhance their popularity. |

|

|

Newspapers say that Nintendo incurs foreign exchange losses associated with a strong yen. Why don't you somehow change dollars and euros into yen? |

|---|---|

|

|

Iwata: Fluctuations in the foreign exchange rates have an impact on how Nintendo announces its financial results in two ways. One is on sales. When we close the books, the company needs to calculate the yen-equivalent of the sales made in non-Japanese yen such as dollars and euros. Therefore, a stronger yen will decrease the sales in yen even though the sales in the original currencies remain the same. On the other hand, a weaker yen will increase the sales in yen even though the original sales in dollars and euro have not increased. This influence on sales affects all exporting companies. For example, since Nintendo' sales in the 70th fiscal year in U.S. dollars were 6.3 billion dollars and euro sales were 3.6 billion euros, one yen change against the dollar would have fluctuated the sales in 6.3 billion yen and one yen change against the euro would have fluctuated the sales in 3.6 billion yen. This impact on sales is true with all exporting companies. In fact, we have been working to purchase in dollars to decrease the influence on yen-denominated sales from large sales in dollars for several years. About 10 years ago, there were few such purchases, but we have been increasing the amount especially in recent years. Nintendo's purchasing with the U.S. dollar in the 70th fiscal year totaled 2.1 billion dollars. This 2.1 billion dollar purchasing has partially offset the effect of 6.3 billion dollar sales. Because many of our business partners prefer payment in dollars, we can mitigate the impact of the dollar in this fashion. On the other hand, when it comes to the euro, we have not found a good measure to decrease the influence from sales in euros. Since the launch of Nintendo DS, our business has expanded the most in Europe and the sales in euros have also drastically increased. Unfortunately, however, we do not have a big supplier in Europe and none of our business partners prefer payment in euros in spite of our efforts so far. Accordingly, regarding the impact of foreign exchange rates on our sales, we still have a business challenge of lessening the effects of sales in euros. The other impact of foreign exchange rates on Nintendo's financial announcements is on foreign currency assets. While the fluctuations in foreign currency affect the sales of any exporting company, in the case of Nintendo, unlike many other exporting companies, it has fairly large amounts of assets in foreign currencies, the yen's value of which is significantly affected by fluctuations in the yen's exchange rate. In closing the books, we always need to calculate these foreign currency assets in Japanese yen by using the foreign exchange rates at the closing date. (The gap is announced as foreign exchange gains or losses in the "non-operating income" or "non-operating expenses" section of our income statement, not in the net sales section, and is one element to cause a gap between our operating income and ordinary income.) Before, when the fluctuations were smaller, this increase or decrease was not so significant. As the interest rates were higher (in foreign currencies than in the yen), it was a great advantage holding assets in foreign currency in past days. Recently, however, the international interest-spread has been decreasing and the foreign exchange rates have been unexpectedly volatile. If we know that a 20-yen appreciation of the yen against the euro would happen in three years time, management would spend three years preparing for that. But a 15-yen appreciation happened from late April to early May. I have discussed this during some media interviews but no management can deal with such a sudden change by any means. In that sense, now might be the time for us to reconsider the pros and cons of foreign currency assets. Simultaneously, however, since a foreign exchange rate will reflect economic fundamentals in the region in the long run, it would be most efficient to hold assets in a proper balance of key currencies. Everyone is now talking about a strong yen, but no one knows when the opposite will occur. We will continue to be diligent in our thinking of the balance of our assets when held in foreign currencies. Please also be advised that we are making efforts to convert foreign currency to yen in as favorable an exchange rate as we can in order to decrease reevaluation losses. As a result, the foreign exchange losses in the 70th fiscal year were just about 0.2 billion yen. We were praised by a securities analyst saying that Nintendo tactfully handled the conversion into the Japanese yen in light of the fluctuations of the foreign exchange rates in the 70th fiscal year. We hope that you will understand that we are making various efforts not to harm the interest of our shareholders. |