for the 68th Fiscal Term Ended March 2008

Apr. 25, 2008 Satoru Iwata, President

My name is Satoru Iwata, president of Nintendo.

Thank you very much for attending this briefing despite your busy schedule today.

Let me first talk about the results for the fiscal year that just ended.

Let me explain the consolidated financial results for the fiscal year ending March 2008 together with the comparison with that of the year before.

The sales of the fiscal year just ended were 1trillion 672billion 400million yen, up 73.0% from the previous year. The increase outside Japan was especially great. Our overseas sales were 1trillion 347billion 900million yen, and the ratio was 80.6%. The operational profit was 487billion 200milliion yen, up 115.6%.

As for the recurring profit, with the foreign currency exchange rates of 100.19yen for U.S. dollar and 158.19yen for euro at the end of the fiscal year, the Japanese yen became stronger in comparison with a year ago, and we accounted 92.3billion yen of reevaluation loss. With this as the main reason, the Recurring Profit increase ratio was 52.6%, which is lower than the year-on-year operational profit growth of 115.6%, and the recurring profit was 440.8billion yen.

With the increase in the recurring profit as the main reason, the net profit was also up 47.7% to become 257.3billion yen. All sales and profit figures renewed our records again.

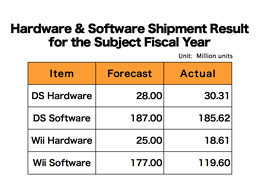

Here, I would like to explain about the consolidated shipments of our main hardware and software in comparison with the forecasts we made in January this year.

Our shipment of Nintendo DS hardware in the subject fiscal year was 30.31million units, which was 810,000 units higher than our forecast. This marks the highest hardware shipment in one year in the history of Nintendo for any one hardware platform. The shipment of DS software was 185.62million units, which was 6.62million units higher than our forecast, which also marks the highest software shipment in one year for any single hardware platform.

Annual Wii hardware shipment also slightly exceeded our forecast to become 18.61million. Wii Software shipment was 119.60million units, which was higher than our forecast by 4.6million.

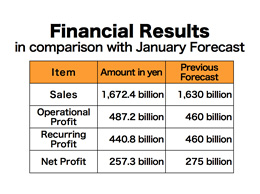

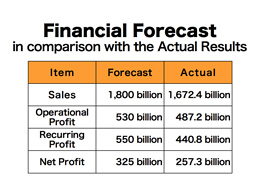

Next, I would like to compare the actual results with the forecasts we made in January this year.

In January we expected the sales to become 1trillion 630billion yen, but the actual result was 1trillion 672billion 400thousand yen.

The actual operational profit of 487.2billion yen was also more than the January forecast of 460billion yen.

As for the recurring profit, mainly because more reevaluation loss was accounted than expected due to the significant changes in exchange rates where yen became very strong against the U.S. dollar, 440.8billion yen of recurring profit was less than our January forecast of 460billion yen.

Here, some of you might wonder, “If yen became so strong at the end of the fiscal year, why could Nintendo realize this huge increase in Operational Profits in comparison to the sales increase ratio? To answer to this question, Nintendo increased the ratio of purchases with the U.S. dollar and our European sales were increased. With these backgrounds, in comparison with the past, the fluctuations in yen-dollar exchange rates affect us a little bit less.

Also, while we were not planning to launch any smash hit titles until this March except for Super Smash Bros. Brawl that hit the Japan market in January and North America in March, this latest edition of Smash Brothers showed stronger than expected launch period sales, and both Nintendo’s first party and our third parties titles in general also showed stronger than expected sales trend. Accordingly, the actual software shipment was more than 11million above our forecast, while the actual hardware shipment was 920,000 units more than the forecast.

Since software sales generate more profit than hardware sales, and since we could eventually reduce a small amount of the fixed expenditures from the time when we made the forecasts, the operational profit increase ratio was larger than the sales increase ratio

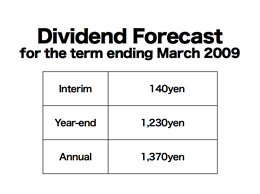

As for the dividend, we are adopting the dividend policy to compare and choose the higher amount of 33% of consolidated operational profit and of 50% of consolidated net profit as the resource for the dividend. We are adopting this policy so that, in case the yen becomes stronger, and we have to account for reevaluation loss, as long as we can maintain the main business operations healthy, the amount of dividend shall not be decreased.

Due to the foreign currency reevaluation loss, the dividend amount becomes higher when we choose the consolidated operational profit. Accordingly, the annual dividend for the subject fiscal year will be 1260yen per share, which is 570yen higher than the previous year.

Since we have already paid 140yen as the interim dividend, the year-end dividend will be 1120yen per share. We are contemplating to ask at our Shareholders’ Meeting to resolve this dividend payout plan.

Now, I would like to talk about our financial forecasts for the currently fiscal year.

About our forecasts for main hardware and software, we are expecting to ship 28million DS hardware units and 187million DS software units, as well as 25million Wii hardware units and 177million units of Wii software.

To achieve these goals, we are preparing for a Wii production increase so that our monthly Wii hardware production capability will reach 2.4million units in July this year.

Based on these unit shipment forecasts, we are expecting the sales to become 1trillion 800billion yen and the operational profit to become 530billion yen in this new and current fiscal year. We are assuming the yen-dollar exchange ratio to be 100yen per dollar, and yen-euro rate to be 155yen per euro, which means that we are expecting yen to be stronger again. Our forecast for the recurring profit is 550billion yen and the net profit forecast is 325billion yen.

As for the dividend forecast, according to the foreign currency exchange rates that we expect, the 33% of consolidated operational profit will yield higher dividend. We are now expecting to pay 1,370 yen as the annual dividend per share, which will be 110yen higher than the dividend for the term ending March 2008.