Semi-Annual Financial Results Briefing

for Fiscal Year Ended March 2009

Oct. 31, 2008 - Satoru Iwata, President

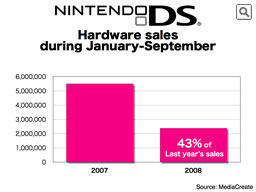

In fact, the domestic sales of DS hardware for January-September period were about 2.36 million units, which is approximately 43% of last year's sales.

This is a rather shocking number when we just look at this one.

On the other hand, when we compare this number with sales figures of several hardware shortly before reaching their market saturation point, selling 2.1million hardware in the non-holiday sales season of January to September 9-month period is not a small number at all.

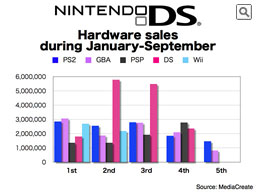

In fact, when we focus in on the hardware which made 2 million sales during January-September period of this year...

* Please note that, during Mr Iwata's presentation, the slide on the left was actually used in his presentation. However there were errors in the slide when we initially posted it to this website. This has now been rectified and the correct slide has now been posted. We would like to sincerely apologize to all for any confusion which may have been caused.

This is all that is left.

The extraordinary sales realized by DS in its first and second years on the market might have confused our senses to have a calm observation of the market.

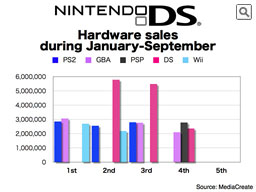

* Please note that, during Mr Iwata's presentation, the slide on the left was actually used in his presentation. However there were errors in the slide when we initially posted it to this website. This has now been rectified and the correct slide has now been posted. We would like to sincerely apologize to all for any confusion which may have been caused.

Even so, some base their forecast upon the past platform cycle theory as well as the stabilized Japanese DS hardware sales as the indicator for the future and predict that Nintendo's Wii and DS businesses may peak out during this fiscal year.

However, we believe that such thinking that what has happened in Japan will be soon reproduced in the overseas markets in the future is too simplistic. We would rather think that we can alter such a peaking-out scenario depending on how we manage our business.

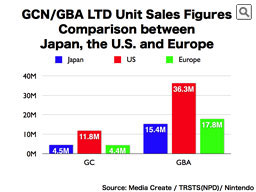

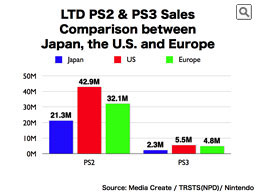

Why don't we look back at how GameCube and GameBoy Advance were selling before DS and Wii came along. Among Japan, the U.S. and Europe, the American market has largely outsold the other markets. In those days, Nintendo's marketing ability in Europe was weak. As a result, more than half of our sales were from the Americas, and the remainder, or little less than 50% of the total Nintendo sales, were almost equally made by Japan and Europe. In our business, however, if we are able to penetrate our products equally in each territory, the final business size must be dependent upon the sheer size of the population. Japan has little more than 127million people. The U.S. has about 300million. As for Europe, just counting the population of countries where Nintendo has been directly marketing its products through its subsidiaries or offices amounts to more than 300million people, and when we look at the entire EU, there are more than 450million people. From the population viewpoint, the U.S. market potential is 2.5 times as much as that of Japan, and Europe has an even bigger business potential. Of course, as of today, the ratio of people who play video games in Europe is less than those in the U.S. and in Japan, and so is their overall percentage of active gamers to their total population. Accordingly, today's European game market's potential is smaller than that of the U.S. On the other hand, we feel that the rapid expansion of the European market must be proof that there are major changes taking place in the active gamer populations in Europe.

When we look at the cumulative sales of Sony's PS2, it reminds us that the U.S. has more than twice the market potential of the Japan, and Europe has more than 1.5 times as much the Japanese market.

As these results date to the time before Nintendo started its challenge to expand the gaming population, the ratio of Europeans who are engaged in gaming today among Europe's total population, especially in the countries where Nintendo has been directly marketing its products, must be increasing. The actual European market potential of today, therefore, must be bigger than what we are seeing on the graph now.

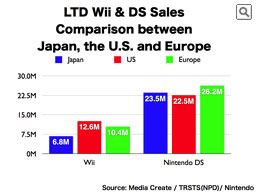

What we are looking at are the cumulative Wii and DS sales through the end of September this year. The graph gives us the impression that Wii has been selling in accordance with their respective market potential in Japan, the U.S. and in Europe. However, the significant market opportunity has yet to come. Fortunately, the software lineup for next year is even richer than this year's. By tackling with several challenges as we discussed in our Nintendo Conference held on October 2nd, it is possible to further expand the markets next year and the year after.

On the other hand, when we look at DS, it is showing a rather unique development in each territory when compared with the original market potentials. This is due to the facts that the gaming population expansion by DS started in Japan, followed by Europe and eventually by the U.S., that there were significant time lags for the expansion to take place in each territory, and that the portable hardware market expanded very rapidly in Japan. The size of the Japanese video game market was originally about the half of the U.S., but four DS software introduced to the Japanese market one after another sold 5 million copies each, which was just unprecedented in the history of video games. When we apply this to the U.S. and Europe, which have bigger market potentials than Japan, it's like 4 software selling 10 million units each one after another, so you can tell how extraordinary the situation was in Japan. And this is how DS reached the 20 million sales mark in less than three years on the market while PS2 needed 6 years and 9 months to achieve the same sell-thru number in Japan. The sales pace in Japan has become more stabilized around the time the cumulative DS sales reached 20million. When we look at the regional sales breakdown of PS2, however, the U.S. and Europe still have large room for sales increase. We feel that there are still more time before we will reach the peak sales point and before our sales shall slow down. Especially Europe, where we feel the strong result of gaming population expansion, must have more market expansion opportunity than how the results of PS2 sales breakdown indicate.

When it comes to Japan, however, there appears to be small room for growth as long as we just stick to the conventional market expansion approach. Accordingly, we will introduce to the Japanese audiences tomorrow...

The "Nintendo DSi" .

As I explained the other day, in order to further promote Nintendo DS platform, following the launches of the original Nintendo DS and Nintendo DS Lite, we have developed Nintendo DSi as...

The 3rd model of Nintendo DS platform.

After our announcement of Nintendo DSi, some media reported their own analysis that Nintendo will try to compete with cell phones, iPod and PSP by adding camera and audio player capabilities to the DS platform. Unfortunately, such reports are not accurately reflecting the real substance of Nintendo DSi.

Certainly, the camera and audio player functions are two of the attractions of DSi. However, while cell phone and digital camera manufacturers have been trying to compete against each other by intensifying the picture pixel quality and zooming ability of their camera functions, and while music players are making its improvements mainly by making smaller exterior design and by increasing memory storage capacity, DSi is trying to propose a different path of evolution by providing the users with the opportunity to be able to touch and play with photographs and sounds. In doing so, we have no intention to compete with any other companies, but rather...