Semi-Annual Financial Results Briefing

for Fiscal Year Ended March 2009

Oct. 31, 2008 - Satoru Iwata, President

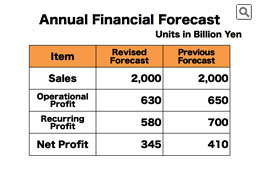

We estimates that the shipment increases will offset the sales decrease in yen due to the higher appreciation of Japanese currency, so we have kept the sales forecast of 2 trillion yen intact. We have slightly lowered the operational profit estimate to 630 billion yen. Since we are now anticipating stronger yen at the end of this fiscal year compared with a year ago, we are currently anticipating reevaluation loss on the assets we have in non-Japanese yen. Accordingly, we are estimating our recurring profit to be 580 billion yen. As a result, we anticipate the annual net profit to be 345 billion yen.

So, the profits forecasts were revised downwardly in comparison with the forecasts we made in August due to the anticipated higher appreciation of yen.

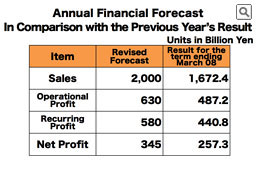

However, as you can see, we are still aiming to achieve increased sales and profits over the last fiscal year.

If these numbers are achieved, we will be able to achieve increases in sales and profits for three consecutive years, and sales and each profit item will be a record highs for us.

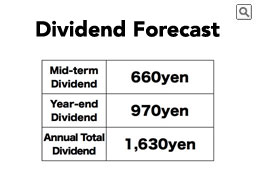

As a result of our financial forecasts revisions and based upon Nintendo's dividend policy, we are now expecting our dividend payouts as stated in this slide. As we are now expecting the reevaluation loss due to the higher appreciation of yen, we are basing upon the 33% of the expected consolidated operational profit as the source of the dividend, not the 50% dividend payout ratio. Compared with our forecast in August, this is a decrease. However, compared with the actual dividend paid for the last fiscal year, we are expecting significant increase in the dividends.

Nintendo has been pushing to break down various paradigms in our attempts to expand the gaming population. What we have done so far might even look preposterous if seen through the old paradigm. For example, shortly after the launch of DS, many people told us that Touch Generations title would never make it in the overseas markets, which are more focused on photo-realistic software. Just a year ago, they said that Wii would end up being a fad. Even today, many still misunderstand that third party software cannot enjoy great sales on Nintendo platforms even when we present to them the opposing data as a fact. Thinking in terms of the past product cycle, or taking into consideration what has happened in Japan so far, some say that even the gaming population expansion is a one-time phenomena, that DS has reached its saturation points and that DS and Wii businesses will peak out this year. What happened in the past can be a clear indicator for the future if one takes the same approach to the same customer as the past. In our case, however, we have been proposing new ideas to the expanded audiences, trying to expand the definition of video games and trying to expand the customers of Nintendo. Will old paradigms still be applicable when the definition of video games and the definition of our customers are expanding? Moving forward, Nintendo may very well make proposals that do not make sense for many others. I believe such an attitude forms the company called Nintendo.

Thank you very much for listening.

We would like to welcome questions from now.