for Fiscal Year Ended March 2009

May 8, 2009 - Presentation by Satoru Iwata, President

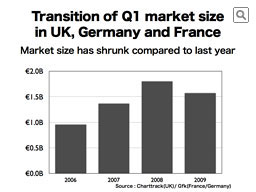

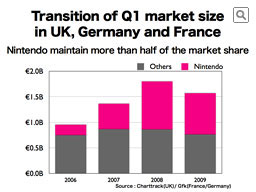

In the same way, I am showing the market size of first quarter of calendar year – January, February and March – in U.K., Germany and France.

Q1 2007 was when Nintendo DS began to sell with great momentum. Q1 2008 was when Wii was added to that. Unfortunately, in the first quarter of this year, market size has shrunk compared to last year.

Under such circumstances, Nintendo platforms still maintain more than half of market share. But contrarily to the U.S. market, the size of Nintendo platforms' sales shares has lowered from last year.

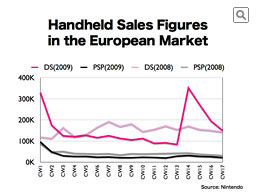

Nintendo gathered the data from independent research companies in the European countries to compile this graph, which shows the weekly sales transitions of portable video game systems. While Nintendo DS showed strong sales at the start of 2009, February and March sales are significantly below the sales of a year ago. This is one of the reasons why the entire European video game market shows a decrease in January-March sales in comparison with the corresponding period a year ago. The fact that Nintendo DSi was scheduled to launch in April must have been another reason for this. Most recently, April sales largely increased on a year-on-year basis because Nintendo DSi was launched in Europe in early April As a result, January to April sales this year were more than that of a year ago.

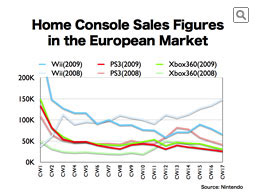

On the other hand, Wii sales during and after March this year is less than that of a year ago. Last year's sales reached a very high level especially because Mario Kart Wii and Wii Fit were launched in Europe in April last year, and because the company was able to increase the Wii hardware production around this time last year. As is the case in the U.S., sales so far this year have been less than that of last year. Since we are scheduling to launch titles that can drive Wii hardware sales during and after summer this year, we are expecting significant sales of Wii to take place mainly around the year-end sales season in Europe too.

As you have seen, stable market expansion is no longer taking place since the beginning of this year. With such figures come out, some people start to make analysis like...

Will what has happened in Japan be the future indicator for overseas markets?

More specifically:

The explosive sales of Nintendo DS was first observed in Japan. Later on, it expanded into the European markets. Finally, the popularization took place in the U.S.

Touch Generations titles which greatly contributed to gaming population expansion, including Nintendogs, Brain Training and Wii Fit, first became hits in Japan. After a while, they were launched in the overseas markets with good sales, which contributed to the gaming population expansion phenomena in the overseas markets.

As the most recent example, Professor Layton software for DS is showing a similar trend by having sold through more than 1.1 million units in Europe, and the U.S. market is following the trend to increase its sales to more than 500,000.

With these facts, some are cementing their beliefs that the Japanese market can indeed be the future indicator for those who forecast the future of the overseas' markets.

With this as the background, ...

Some analysts have assumed that, now that the sales of DS and Wii are slowing down in Japan which can be a future indicator for other markets, the same thing can happen in the U.S. and in Europe in the near future. Some media are writing articles based upon the comments from such analysts.

Since information spread very rapidly in Japan and the speed at which fads come and go is quicker than any other countries, the company recognizes that Japan is one of the most challenging markets in the world in terms of maintaining momentum, and we know that we have some issues we need to tackle with. With the launch of Nintendo DSi at the end of last year, we have been able to gain back the momentum of the Nintendo DS business to a certain extent. On the other hand, Wii's sales are slowing down in Japan, and even though the overseas Wii sales are still at a very high level today, they are less than the sales achieved a year ago. In such a circumstance, the assertion from these analysts may sound persuasive on the surface. However, we are concerned that such an assertion based upon the assumption that Japan is the future indicator for other markets can be misleading, and we have the will to make different things happen.

The most simple refutation to the Japan-as-the-indicator-for-other-market assumption is the fact that the Wii began recording its strong sales simultaneously around the world, which was not the case with Nintendo DS. In other words, Wii did not first sell well in Japan with the rest of the world following suit. As of now, the ratio of Wii sales per population is almost the same between Japan and the U.S. at little more than 6%.

The assumption that Japan is always the future indicator is not always correct.

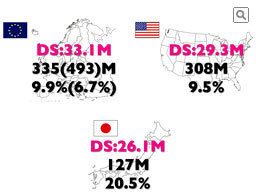

And as we have explained several times in the past, the ratio of DS unit sales to population is largely different between Japan and the rest of the world.

This compares Nintendo DS' installed base and the population in the three different markets as of the end of March 2009. In Japan, more than one in five people own a DS. On the other hand, in the U.S. and in Europe, the sales have not yet reached to one in 10 people yet.

Even in Japan where the DS' ownership ratio to the population is very high, Nintendo DS sales are continuing, so it can be said that there is still ample room for penetration in the overseas markets.