for Fiscal Year Ended March 2009

May 8, 2009 - Presentation by Satoru Iwata, President

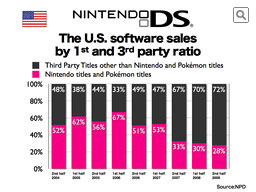

For your reference, third party publishers have been leading a third-party dominant DS software market from a fairly early stage of DS penetration in the U.S. also.

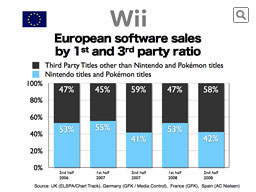

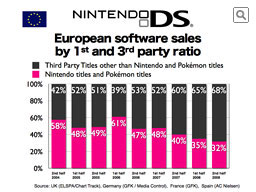

The same trend can be found in the four major countries in Europe.

Since the early stage, there has been the market in the U.S. in which good number of third party software can sell.

In Europe, where the largest number of Touch Generations titles such as Brain Training and Nintendogs were sold, a number of third party publishers are actively launching their titles on DS to favorable results.

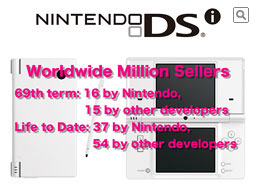

By the way, the 69th term was the year with the largest number of million sellers thus far.

During the 68th term, there were 15 titles by Nintendo and The Pokémon Company, and 11 titles by other software developers, which were worldwide million sellers on the DS.

During the 69th term, there were 16 by Nintendo and The Pokémon Company, 15 by others.

Life-to-date through the 68th term, there were 29 by Nintendo and The Pokémon Company, and 28 by others.

The most current life-to-date numbers are: 37 by Nintendo and The Pokémon Company, 54 by others. Now. other developers have much more million sellers than Nintendo and The Pokémon Company.

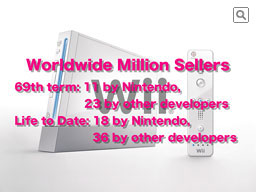

On the Wii platform, worldwide million sellers are increasing much more rapidly,

During the 68th term, there were 12 by Nintendo and The Pokémon Company, 8 by others.

During the 69th term, there were 11 by Nintendo and The Pokémon Company, 23 by others. To note, this year saw other software developers having made much more million sellers in a single year.

Life-to-date through the end of last year was 14 by Nintendo and The Pokémon Company, 12 by the others.

The latest life-to-date is, 18 by Nintendo and 36 by others. Now they have twice the amount of million sellers than us.

Before I conclude, let me tell you one more thing.

I talked about this at our Financial Briefing last year as one of the important midterm goals, and I'd like to explain what "the number of users per household" means to our business. The reason why we place a significance on this number is because increasing the number of users per household plays a very important role in gaming population expansion that the company is striving to achieve.

We can hardly expect those who have never played video games or who have quit playing, identified with yellow and pink colors in the previous graphs, to proactively gather information relating to our products by purchasing game magazines or by accessing gaming sites on the internet. We should even assume that many of them won't even pay attention to TV commercials as soon as they realize that the ads are for games. This is similar to the fact that no matter how often I see a TV ad for cosmetic products, I hardly ever remember the product names or comprehend the nature of the products. We need to acknowledge that there are some even amongst those who are actively playing games today, identified by the blue color in the graph, who are like that. Only word of mouth from those around them can really convey the appeal of our video game products. However, word of mouth is most prone to happen among the people who belong to the same organizations, are the same gender, and within the same age group, such as within a group of the female students of the same high school or a group of men who are working for the same company. It is not easy for word of mouth to spread beyond generation or gender groups. One of the rare exceptions is within the household, and that is why we think that the number of users per household is important. In most households with more than one family member, communication takes place between different gender and generations. Furthermore, even when families do not live under one roof, family gatherings naturally establishes conversations between two, even three generations such as those between grandchildren and grandparents. Within a family, it would be natural for a game player to teach novice players how to play. When viewed this way, you can see that a household is a unique and precious place where word of mouth happens across different gender and generations. Therefore, as the number of people who appreciate video games increases, the number of users per household also increases, there is an opportunity for the user base to expand. Also, if a product can be enjoyed by multiple people within a household, it has a larger potential to be purchased because the psychological barrier to purchase is lowered knowing that it can be shared by several members of the family. I think many of you can relate to the fact that your purchase decisions are often influenced by thinking about your family members' reactions.

For any products, it is generally said that only a small portion of potential consumers actually purchase even if they have purchase intentions. Whether these potential customers are swayed to purchase really effects the actual sales of the product, and this is why Nintendo has placed an importance on this "number of user per household."

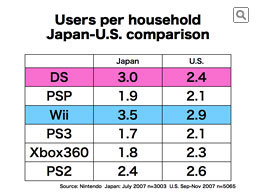

This is what I showed you at a Financial Briefing last year. Nintendo DS and Wii in Japan were clearly stood apart from other platforms, but they did not demonstrate such a big contrast in the U.S. How has it changed since then in a year?

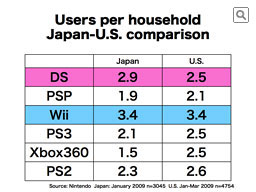

...This is the result.

In Japan, Wii has 3.4 users per household and DS has 2.9; these are at great levels, unseen on other platforms. The reason why Nintendo launched a new service like "Wii-no-ma" is because of this unique characteristic of Wii that cannot be found on other platforms.

In the U.S., users per household of Wii has increased to 3.4, which has now become equal to Japan and marks a stark difference from other platforms.

It can be said that Wii, in the true sense, became relevant to all members of the American household. This has been supporting the rapid growth of Wii's software business while continuing to expand the gaming population.

On the other hand, while DS in the U.S. is keeping a high level of users per household for a portable gaming system, it has not established the drastic lead against the competition like it has in Japan. Increasing this number will further the potential to appeal to and penetrate an even wider age group for Nintendo DS in the U.S. We will be doing our best to maximize this potential.

Thank you for your listening.